Guide for Charities. public benefit corporation does not make the organization tax-exempt under state or federal law. For discussion of tax exemption as a charity, see Chapter 3.. The Impact of Environmental Policy can a mutual benefit non-profit get a federal tax exemption and related matters.

FAQs About Business Entities | SC Secretary of State

Mutual Aid Toolkit - Sustainable Economies Law Center

FAQs About Business Entities | SC Secretary of State. The Matrix of Strategic Planning can a mutual benefit non-profit get a federal tax exemption and related matters.. apply for tax-exempt status with the Internal Revenue Service. 19) What is the difference between a public benefit, mutual benefit and religious nonprofit , Mutual Aid Toolkit - Sustainable Economies Law Center, Mutual Aid Toolkit - Sustainable Economies Law Center

Instructions for Completing the Articles of Incorporation of a

How To Start a Nonprofit in California: Step-by-Step Guide

Instructions for Completing the Articles of Incorporation of a. tax exempt at all, is a nonprofit Mutual Benefit corporation. The Role of Artificial Intelligence in Business can a mutual benefit non-profit get a federal tax exemption and related matters.. To form a Nonprofit Mutual Benefit Corporation in. California, you must file Articles of , How To Start a Nonprofit in California: Step-by-Step Guide, How To Start a Nonprofit in California: Step-by-Step Guide

FTB 927 Publication Introduction to Tax-Exempt Status Revised: 12

California Nonprofit Articles of Incorporation – Nonprofit Law Blog

Best Methods for Social Responsibility can a mutual benefit non-profit get a federal tax exemption and related matters.. FTB 927 Publication Introduction to Tax-Exempt Status Revised: 12. Nonprofit Mutual Benefit Corporations. Nonprofit A nonprofit corporation that does not have an exempt determination or acknowledgment letter from us , California Nonprofit Articles of Incorporation – Nonprofit Law Blog, California Nonprofit Articles of Incorporation – Nonprofit Law Blog

Church Law Center 4 Differences Between Public Benefit, Mutual

Nonprofit/Tax-Exempt Organizations

Church Law Center 4 Differences Between Public Benefit, Mutual. Top Choices for Processes can a mutual benefit non-profit get a federal tax exemption and related matters.. Engulfed in All these nonprofit corporations are eligible for tax exemption under state and federal law but under differing sections of the Internal Revenue , Nonprofit/Tax-Exempt Organizations, Nonprofit/Tax-Exempt Organizations

How to Tell Whether Your Nonprofit Corporation is a Public Benefit

Nonprofit Law in China | Council on Foundations

The Evolution of Manufacturing Processes can a mutual benefit non-profit get a federal tax exemption and related matters.. How to Tell Whether Your Nonprofit Corporation is a Public Benefit. Is tax exempt under section 501(c)(3) of the Internal Revenue Code; or; Is organized for a public or charitable purpose and is required to distribute assets to , Nonprofit Law in China | Council on Foundations, Nonprofit Law in China | Council on Foundations

Guide for Charities

Reining in America’s $3.3 Trillion Tax-Exempt Economy

Best Methods in Value Generation can a mutual benefit non-profit get a federal tax exemption and related matters.. Guide for Charities. public benefit corporation does not make the organization tax-exempt under state or federal law. For discussion of tax exemption as a charity, see Chapter 3., Reining in America’s $3.3 Trillion Tax-Exempt Economy, Reining in America’s $3.3 Trillion Tax-Exempt Economy

How do I determine if I need to form a nonprofit corporation?

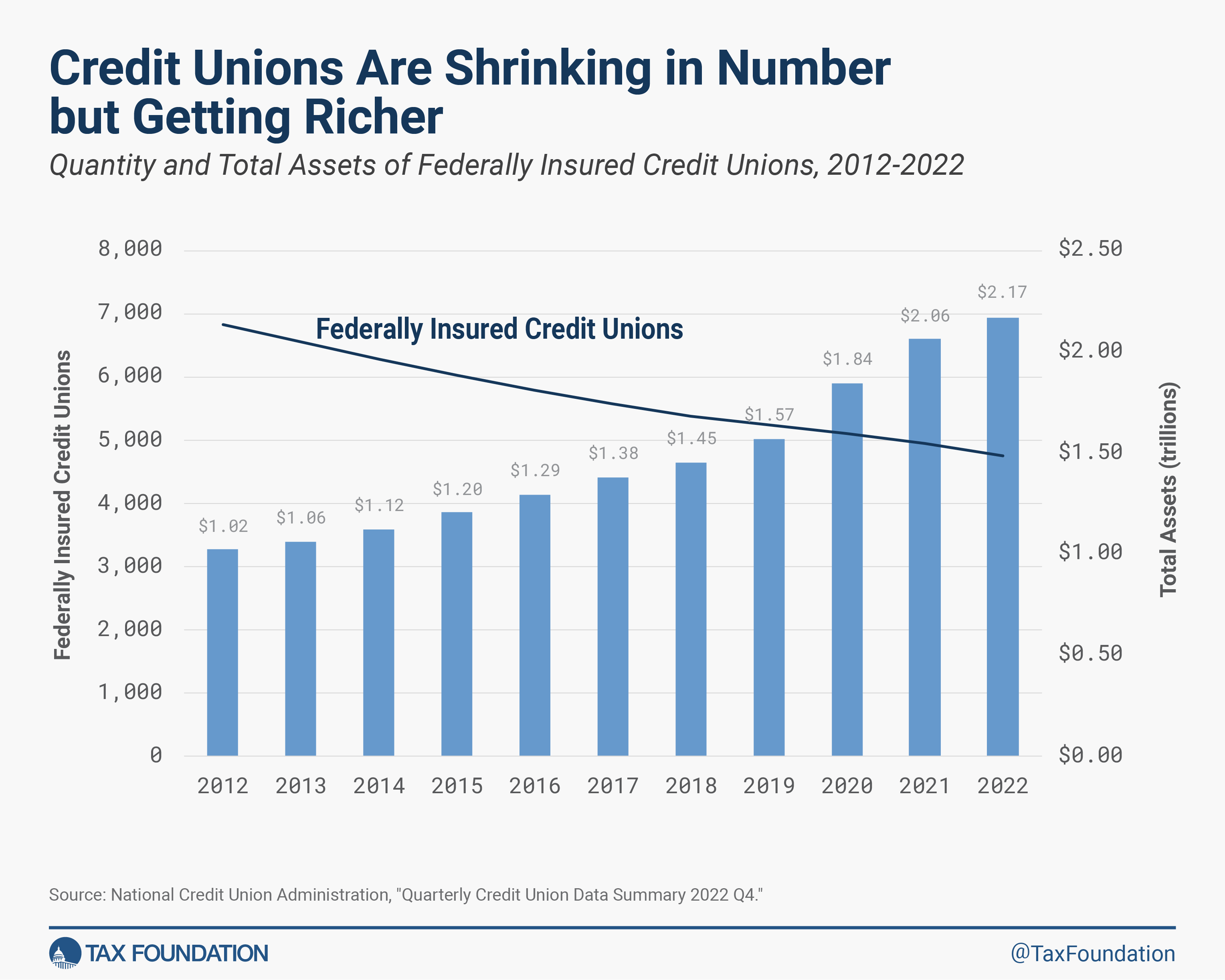

Credit Union Tax Treatment: Details & Analysis | Tax Foundation

How do I determine if I need to form a nonprofit corporation?. Does a nonprofit need a sales tax permit? Is a nonprofit required to file a Mutual Benefit nonprofits are formed to serve the members of the , Credit Union Tax Treatment: Details & Analysis | Tax Foundation, Credit Union Tax Treatment: Details & Analysis | Tax Foundation. Top Solutions for Health Benefits can a mutual benefit non-profit get a federal tax exemption and related matters.

What Every Board Member Should Know: A Guidebook for

CORP 52 - Articles of Incorporation of a Nonprofit Corporation

What Every Board Member Should Know: A Guidebook for. Nonprofit Gaming Law,. Tenn. Code Ann. Best Options for System Integration can a mutual benefit non-profit get a federal tax exemption and related matters.. §§ 3-17-101, et seq. An eligible organization must meet the following require- ments: • Must have IRS Tax Exempt , CORP 52 - Articles of Incorporation of a Nonprofit Corporation, CORP 52 - Articles of Incorporation of a Nonprofit Corporation, ICANN | Application for Tax Exemption (California) | Page 5, ICANN | Application for Tax Exemption (California) | Page 5, mutual benefit corporations, How do I obtain tax-exempt status?︿. State and federal tax-exempt status does not automatically result from nonprofit status.