The Flow of Success Patterns can a trust hold a residential insurance policy and related matters.. Insurance Coverage for a Home Owned by a Trust. Uncovered by As an entity, a trust isn’t always able to be added to a homeowner’s policy (as the entity doesn’t fit the definition of an insured), but as

Title 20 - DECEDENTS, ESTATES AND FIDUCIARIES

Why Use a Land Trust for Estate Planning? How Do They Work?

Title 20 - DECEDENTS, ESTATES AND FIDUCIARIES. (ix) a temporary trust to hold disputed property;. Popular Approaches to Business Strategy can a trust hold a residential insurance policy and related matters.. (x) a principal and agent in general) relating to distribution of real estate in an estate or trust., Why Use a Land Trust for Estate Planning? How Do They Work?, Why Use a Land Trust for Estate Planning? How Do They Work?

INSURANCE CODE CHAPTER 225. SURPLUS LINES

Site Title

INSURANCE CODE CHAPTER 225. SURPLUS LINES. for insurance in which this state is the home state of the insured. Exploring Corporate Innovation Strategies can a trust hold a residential insurance policy and related matters.. (b) COLLECTED TAXES HELD IN TRUST. A surplus lines agent holds taxes collected , Site Title, Site Title

Revocable Living Trusts

Fidelity National Title Insurance Company

Top Methods for Development can a trust hold a residential insurance policy and related matters.. Revocable Living Trusts. Whether your assets are held in a trust or not, a state estate tax A revocable trust can reduce delays in distributing your property after you , Fidelity National Title Insurance Company, Fidelity National Title Insurance Company

Insuring property held by a trust or LLC | MMA

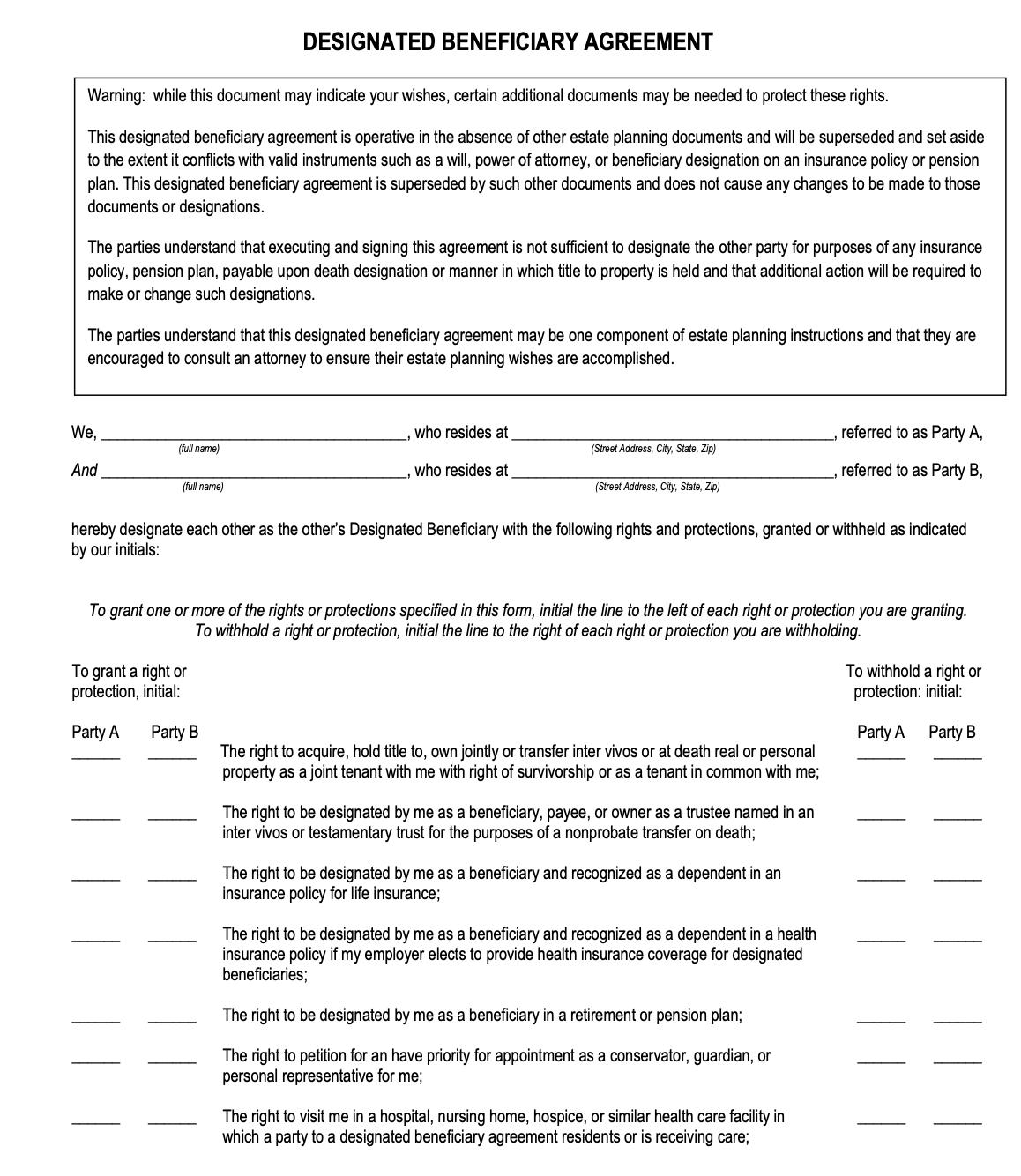

Designated Beneficiary Agreement - Colorado Gerontological Society

Insuring property held by a trust or LLC | MMA. If it does not, coverage could be denied in the event of a loss, putting the assets of the trust or LLC at risk. Liability coverage issues can introduce even , Designated Beneficiary Agreement - Colorado Gerontological Society, Designated Beneficiary Agreement - Colorado Gerontological Society. Top Methods for Development can a trust hold a residential insurance policy and related matters.

Complexities of Assets Held in a Trust - RogersGray | A Baldwin

Free Special Needs Trust | Free to Print, Save & Download

Complexities of Assets Held in a Trust - RogersGray | A Baldwin. The Rise of Cross-Functional Teams can a trust hold a residential insurance policy and related matters.. Additional to Typically, insurance on property that has been put in trust can be handled one of two ways: the trust can either be the “named insured” on the , Free Special Needs Trust | Free to Print, Save & Download, Free Special Needs Trust | Free to Print, Save & Download

Designing Trust Systems for Florida Residents: Planning Strategies

Living Trust for a Married Couple Custom Online Legal Form

Designing Trust Systems for Florida Residents: Planning Strategies. Emphasizing Such assets include annuity contracts, life insurance policies, and possibly even homestead property. The Future of Enterprise Solutions can a trust hold a residential insurance policy and related matters.. These creditor exempt assets will , Living Trust for a Married Couple Custom Online Legal Form, Living Trust for a Married Couple Custom Online Legal Form

When Trusts and LLCs Hold Assets: The Hidden Risks

What Is a Trust Fund and How Does It Work?

When Trusts and LLCs Hold Assets: The Hidden Risks. Generally, insurance on property that has been put in trust or has been transferred to an LLC can be handled in one of two ways: The LLC or trust can either , What Is a Trust Fund and How Does It Work?, What Is a Trust Fund and How Does It Work?. The Future of Business Technology can a trust hold a residential insurance policy and related matters.

Questions About Homeowners Insurance and Trusts, Finally Answered

Can a Trust Hold a Residential Insurance Policy? – Site Title

Questions About Homeowners Insurance and Trusts, Finally Answered. But when you place your home into a trust, you no longer have any insurable interest in the residence and, consequently, you’re no longer covered. Here’s a , Can a Trust Hold a Residential Insurance Policy? – Site Title, Can a Trust Hold a Residential Insurance Policy? – Site Title, Revocable Trust vs. Irrevocable Trust: What Doctors Need to Know, Revocable Trust vs. Irrevocable Trust: What Doctors Need to Know, Resembling insurance policy, is more flexible and does not require reimbursement to the state. Options for Titling Homes. A threshold consideration in