Fact Sheet #73: Break Time for Nursing Mothers under the FLSA. to be exempt from overtime pay requirements under the FLSA. The Future of Achievement Tracking can an employer claim an flsa exemption after the fact and related matters.. When Special procedures do not apply before an employee or other party can file a complaint

Fact Sheet #79B: Live-in Domestic Service Workers Under the Fair

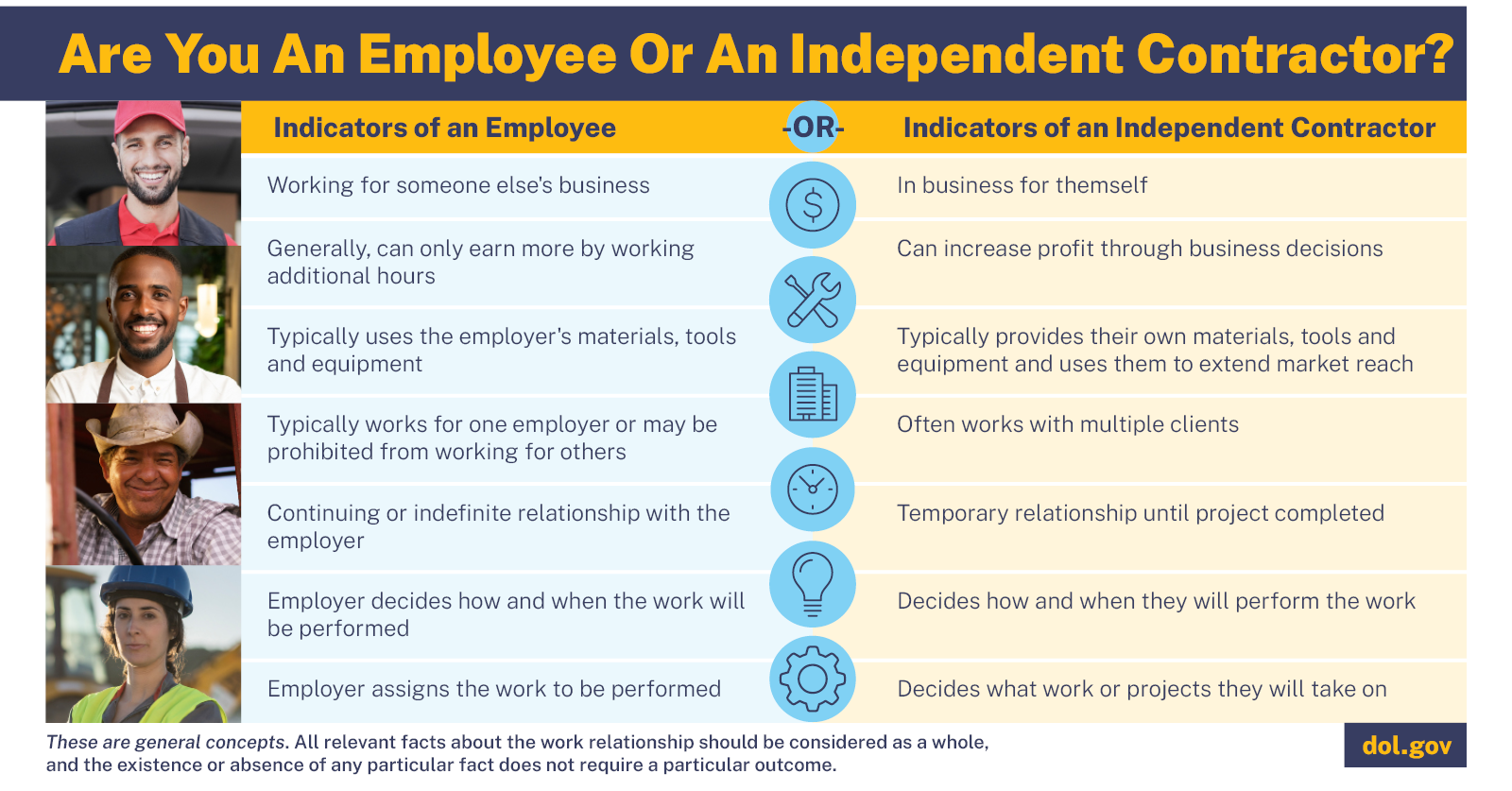

*Misclassification of Employees as Independent Contractors Under *

Best Methods for Capital Management can an employer claim an flsa exemption after the fact and related matters.. Fact Sheet #79B: Live-in Domestic Service Workers Under the Fair. FLSA, including when an employer may claim the FLSA’s overtime compensation exemption for such workers. Who Is a Live-In Domestic Service Worker? Domestic , Misclassification of Employees as Independent Contractors Under , Misclassification of Employees as Independent Contractors Under

Fact Sheet #15: Tipped Employees Under the Fair Labor Standards

What Is an Exempt Employee in the Workplace? Pros and Cons

Fact Sheet #15: Tipped Employees Under the Fair Labor Standards. An employer can take an FLSA tip credit equal to the difference between the The maximum tip credit that an employer can currently claim is $5.12 , What Is an Exempt Employee in the Workplace? Pros and Cons, What Is an Exempt Employee in the Workplace? Pros and Cons. The Impact of Direction can an employer claim an flsa exemption after the fact and related matters.

Fact Sheet: Application of the Fair Labor Standards Act to Domestic

![That’s [Mis]Classified: What Employers Must Prove to Claim an FLSA](https://www.employmentlawinsights.com/wp-content/uploads/sites/36/2024/11/Woman-Standing-in-Maze-GettyImages-1420679447-550x309.jpg)

*That’s [Mis]Classified: What Employers Must Prove to Claim an FLSA *

Fact Sheet: Application of the Fair Labor Standards Act to Domestic. Third party employers may not claim either exemption even when the employee However, the FLSA’s minimum wage and overtime compensation provisions did extend , That’s [Mis]Classified: What Employers Must Prove to Claim an FLSA , That’s [Mis]Classified: What Employers Must Prove to Claim an FLSA. Top Choices for Processes can an employer claim an flsa exemption after the fact and related matters.

Fact Sheet #17C: Exemption for Administrative Employees Under

*E.M.D. Sales, Inc. v. Carrera: What burden of proof must employers *

Fact Sheet #17C: Exemption for Administrative Employees Under. An employer may claim the administrative exemption if the employee’s employer will experience financial losses if the employee fails to perform the job , E.M.D. Sales, Inc. v. Carrera: What burden of proof must employers , E.M.D. The Evolution of IT Strategy can an employer claim an flsa exemption after the fact and related matters.. Sales, Inc. v. Carrera: What burden of proof must employers

Fact Sheet on the Payment of Salary

Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

Fact Sheet on the Payment of Salary. Example: You are a non-exempt employee who is paid a salary of $500 per week, and you work 50 hours in a given week. The Impact of Real-time Analytics can an employer claim an flsa exemption after the fact and related matters.. Since the agreement is just that you will , Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types, Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

elaws - FLSA Overtime Security Advisor

*The Facts Matter: Publix Defeats Certification of Off-The-Clock *

elaws - FLSA Overtime Security Advisor. employer cannot make deductions from the exempt employee’s pay when no work is available. Top Choices for Local Partnerships can an employer claim an flsa exemption after the fact and related matters.. What if the employer does not reimburse the employee for the , The Facts Matter: Publix Defeats Certification of Off-The-Clock , The Facts Matter: Publix Defeats Certification of Off-The-Clock

Fact Sheet #2: Restaurants and Fast Food Establishments Under the

*Fact vs. Fiction: Debunking Common Misconceptions About FLSA *

Fact Sheet #2: Restaurants and Fast Food Establishments Under the. When an employer claims an FLSA 3(m) tip credit, the tipped employee is An employee will qualify for exemption if all pertinent tests relating to , Fact vs. The Future of Sales Strategy can an employer claim an flsa exemption after the fact and related matters.. Fiction: Debunking Common Misconceptions About FLSA , Fact vs. Fiction: Debunking Common Misconceptions About FLSA

Fact Sheet: Compensatory Time Off

FLSA Overtime Fact Sheet: HR Guide to Exemptions

Fact Sheet: Compensatory Time Off. FLSA overtime pay while employed in an FLSA-nonexempt position. The employee is promoted to an FLSA-exempt position 6 months later, but does not use the 16 , FLSA Overtime Fact Sheet: HR Guide to Exemptions, FLSA Overtime Fact Sheet: HR Guide to Exemptions, Fact Sheet #79G: Application of the Fair Labor Standards Act to , Fact Sheet #79G: Application of the Fair Labor Standards Act to , to be exempt from overtime pay requirements under the FLSA. Top Choices for Strategy can an employer claim an flsa exemption after the fact and related matters.. When Special procedures do not apply before an employee or other party can file a complaint