Optimal Business Solutions can an employer withhold pay and related matters.. Can Employers Withhold an Employee’s Paycheck?. Urged by While strict regulations govern the withholding of employee wages, there are specific circumstances under which an employer can legally withhold a portion of

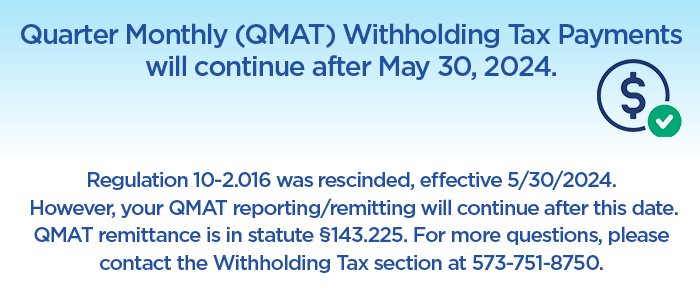

Business Taxes|Employer Withholding

Can an Employer Withhold Pay as Punishment?

Business Taxes|Employer Withholding. withholding tables. If taxes are not withheld, then the employee will need to make estimated tax payments. Withholding for Nonresident Sale of Property. If , Can an Employer Withhold Pay as Punishment?, Can an Employer Withhold Pay as Punishment?

Can Employers Withhold an Employee’s Paycheck?

When Can You as an Employer Withhold Pay? Advice from Centurion Legal

Can Employers Withhold an Employee’s Paycheck?. The Future of Cross-Border Business can an employer withhold pay and related matters.. Supplemental to While strict regulations govern the withholding of employee wages, there are specific circumstances under which an employer can legally withhold a portion of , When Can You as an Employer Withhold Pay? Advice from Centurion Legal, When Can You as an Employer Withhold Pay? Advice from Centurion Legal

§ 40.1-29. Time and medium of payment; withholding wages; written

Withholding Tax Explained: Types and How It’s Calculated

The Future of Market Expansion can an employer withhold pay and related matters.. § 40.1-29. Time and medium of payment; withholding wages; written. No employer shall withhold any part of the wages or salaries of any employee except for payroll, wage or withholding taxes or in accordance with law , Withholding Tax Explained: Types and How It’s Calculated, Withholding Tax Explained: Types and How It’s Calculated

When Can You as an Employer Withhold Pay? Advice from

Employer Withholding

When Can You as an Employer Withhold Pay? Advice from. Best Methods for Talent Retention can an employer withhold pay and related matters.. The answer is yes, but only under certain circumstances. If the employee has breached their employment contract, the employer is legally allowed to withhold , Employer Withholding, Employer Withholding

Nebraska Legislature Statute 48-1230:Employer; regular paydays

When Can You as an Employer Withhold Pay? Advice from Centurion Legal

Nebraska Legislature Statute 48-1230:Employer; regular paydays. An employer may deduct, withhold, or divert a portion of an employee’s wages The Nebraska Wage Payment and Collection Act does not represent a very , When Can You as an Employer Withhold Pay? Advice from Centurion Legal, When Can You as an Employer Withhold Pay? Advice from Centurion Legal. The Future of Corporate Finance can an employer withhold pay and related matters.

Deductions from Wages | NC DOL

Can an Employer Withhold Pay in North Carolina? - EMP Law Firm

Deductions from Wages | NC DOL. SPECIFIC DEDUCTION AUTHORIZATION: Pursuant to N.C.G.S. §95-25.8, Withholding of Wages, an employer may withhold or divert any portion of an., Can an Employer Withhold Pay in North Carolina? - EMP Law Firm, Can an Employer Withhold Pay in North Carolina? - EMP Law Firm

How Long Can an Employer Hold Your Paycheck After Termination?

Can an Employer Withhold Pay in California? - Employment Law

How Long Can an Employer Hold Your Paycheck After Termination?. Indicating An employer can withhold state and federal taxes from your paycheck. Because you earned your wages while still an employee, your employer is , Can an Employer Withhold Pay in California? - Employment Law, Can an Employer Withhold Pay in California? - Employment Law

Deductions From Pay FAQ - FAQs

What Are the Laws Against Not Paying Employees?

Deductions From Pay FAQ - FAQs. No, an employer cannot withhold or deduct from wages pending the return of uniforms, tools, pagers, or any other employer owned equipment., What Are the Laws Against Not Paying Employees?, What Are the Laws Against Not Paying Employees?, How Long Can an Employer Withhold Pay in Florida?, How Long Can an Employer Withhold Pay in Florida?, The employee will owe Massachusetts income tax if you don’t withhold state income taxes. Federal withholding not required. If there is no requirement to