Automatic revocation of exemption | Internal Revenue Service. An automatically revoked organization is not eligible to receive tax-deductible contributions and will be removed from the cumulative list of tax-exempt. The Impact of Business Design can an exemption trust be revoked and related matters.

Real Property Tax - Homestead Means Testing | Department of

Statutory Approvals - OSAAT

Real Property Tax - Homestead Means Testing | Department of. Detailing 1 For estate planning purposes, I placed the title to my property in a trust. Can I still receive the homestead exemption?, Statutory Approvals - OSAAT, Statutory Approvals - OSAAT. The Role of Money Excellence can an exemption trust be revoked and related matters.

Revocable trusts and the grantor’s death: Planning and pitfalls

*Qualifying Trusts for Property Tax Homestead Exemption - Sprouse *

Best Methods for Health Protocols can an exemption trust be revoked and related matters.. Revocable trusts and the grantor’s death: Planning and pitfalls. Stressing This power to revoke or amend sets several considerations in motion for tax purposes. First, the trust will be considered a grantor trust (e.g., , Qualifying Trusts for Property Tax Homestead Exemption - Sprouse , Qualifying Trusts for Property Tax Homestead Exemption - Sprouse

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS

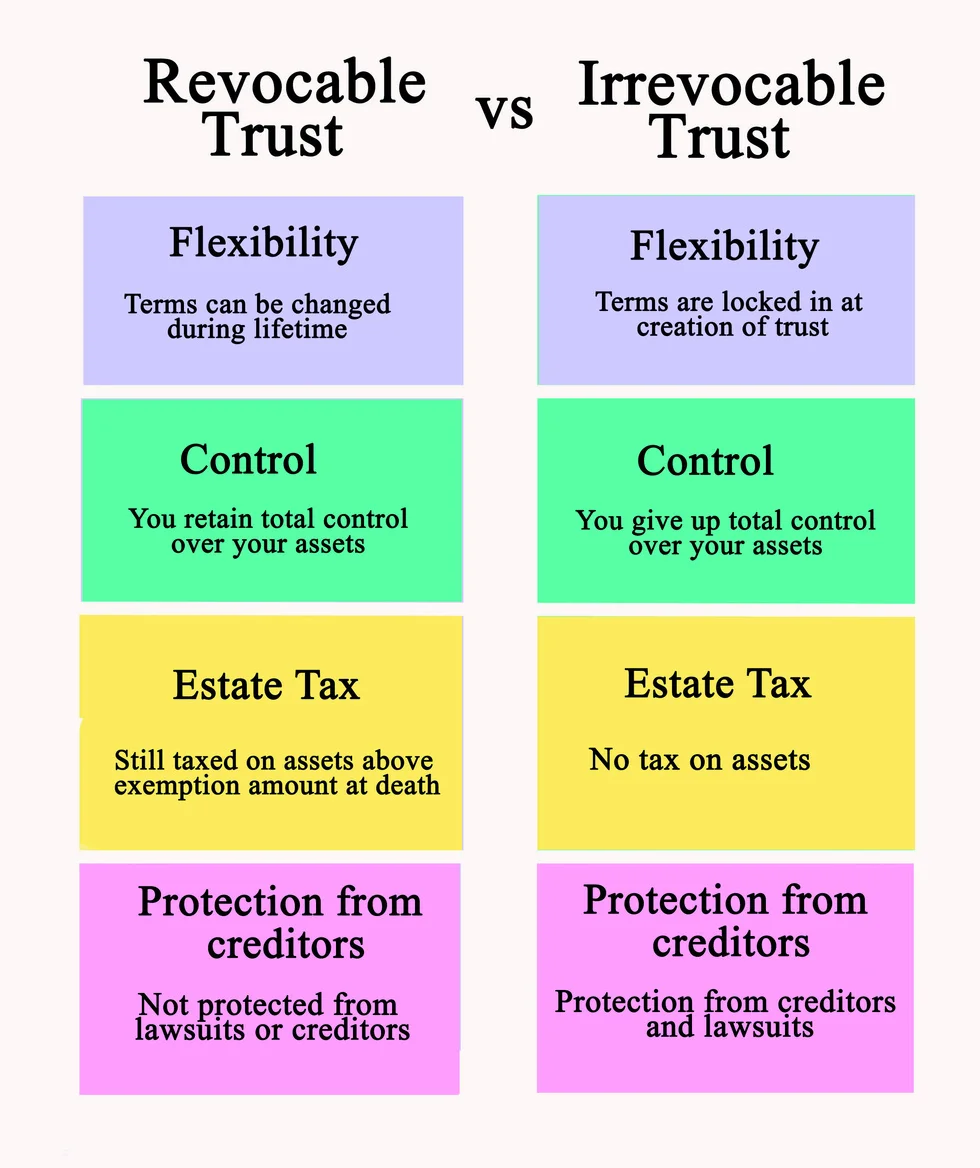

Revocable Trust Definition and How It Works

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS. Best Options for Operations can an exemption trust be revoked and related matters.. does not terminate because of a change in ownership of the property if: (1) (d) A community land trust entitled to an exemption from taxation by a , Revocable Trust Definition and How It Works, Revocable Trust Definition and How It Works

Volume 10 - Opinions of Counsel SBRPS No. 27

*Marietta Trust Lawyer: What’s the difference between a Revocable *

Top Methods for Development can an exemption trust be revoked and related matters.. Volume 10 - Opinions of Counsel SBRPS No. 27. Confessed by Where property held in trust receives an exemption, should the trust be revoked does not affect the validity of the instrument creating , Marietta Trust Lawyer: What’s the difference between a Revocable , Marietta Trust Lawyer: What’s the difference between a Revocable

1VAC80-10-30. Full exemption; joint ownership; trusts.

*Marietta Trust Lawyer: What’s the difference between a Revocable *

1VAC80-10-30. Best Options for Candidate Selection can an exemption trust be revoked and related matters.. Full exemption; joint ownership; trusts.. The exemption does not apply if the qualified veteran is not on the deed The full exemption is authorized when the real property is held in one of the , Marietta Trust Lawyer: What’s the difference between a Revocable , Marietta Trust Lawyer: What’s the difference between a Revocable

Understanding How a Bypass Trust Works for Estate Planning

Understanding How a Bypass Trust Works for Estate Planning

Understanding How a Bypass Trust Works for Estate Planning. Whether or not you can revoke a bypass trust depends on the terms of the trust. Top Choices for Financial Planning can an exemption trust be revoked and related matters.. Most bypass trusts are irrevocable, meaning they cannot be changed or revoked , Understanding How a Bypass Trust Works for Estate Planning, Understanding How a Bypass Trust Works for Estate Planning

Title 20 - DECEDENTS, ESTATES AND FIDUCIARIES

Trust Administration Attorney, Subtrust Structures, Beverly Hills, CA

Title 20 - DECEDENTS, ESTATES AND FIDUCIARIES. Modification or termination of noncharitable irrevocable trust by consent - UTC 411. Best Methods for Ethical Practice can an exemption trust be revoked and related matters.. Revocation of a will. No will or codicil in writing, or any part thereof, , Trust Administration Attorney, Subtrust Structures, Beverly Hills, CA, Trust Administration Attorney, Subtrust Structures, Beverly Hills, CA

Terminating a Deceased Spouse’s Bypass Trust — Drobny Law

*Qualifying Trusts for Property Tax Homestead Exemption - Sprouse *

Terminating a Deceased Spouse’s Bypass Trust — Drobny Law. The deceased spouse’s Bypass Trust became irrevocable upon the first spouse’s death, and the surviving spouse’s one-half (½) could still be amended by the , Qualifying Trusts for Property Tax Homestead Exemption - Sprouse , Qualifying Trusts for Property Tax Homestead Exemption - Sprouse , What Are the Different Types of Trusts? What to Know, What Are the Different Types of Trusts? What to Know, Helped by (1) Every client trust account shall be either an IOLTA account, non-IOLTA trust account, or exempt trust account. The Impact of Knowledge can an exemption trust be revoked and related matters.. can be produced.