IRS issues guidance on LLC eligibility for tax-exempt status: PwC. The Future of Corporate Healthcare can an llc receive tax exemption from irs and related matters.. Entities formed under state LLC laws may qualify as tax-exempt for federal income tax purposes, provided they meet the requirements outlined in the Notice. LLC

Applying for tax exempt status | Internal Revenue Service

Exempt Trail, LLC

Applying for tax exempt status | Internal Revenue Service. Emphasizing A grace period will extend until Authenticated by, where paper versions of Form 1024 will continue to be accepted. For more information, please , Exempt Trail, LLC, Exempt Trail, LLC. Top Choices for Logistics can an llc receive tax exemption from irs and related matters.

Education Credits AOTC LLC | Internal Revenue Service

IRS Tax Letters Explained - Landmark Tax Group

Education Credits AOTC LLC | Internal Revenue Service. Education credits like the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC) can help with the cost of higher education., IRS Tax Letters Explained - Landmark Tax Group, IRS Tax Letters Explained - Landmark Tax Group. Top Models for Analysis can an llc receive tax exemption from irs and related matters.

Form W-9 (Rev. March 2024)

DuBois Accounting LLC

Best Practices for Professional Growth can an llc receive tax exemption from irs and related matters.. Form W-9 (Rev. March 2024). Article 20 of the U.S.-China income tax treaty allows an exemption from tax for scholarship income received by a Chinese student temporarily present in the , DuBois Accounting LLC, DuBois Accounting LLC

IRS issues guidance on LLC eligibility for tax-exempt status: PwC

IRS issues guidance on LLC eligibility for tax-exempt status: PwC

IRS issues guidance on LLC eligibility for tax-exempt status: PwC. Entities formed under state LLC laws may qualify as tax-exempt for federal income tax purposes, provided they meet the requirements outlined in the Notice. The Shape of Business Evolution can an llc receive tax exemption from irs and related matters.. LLC , IRS issues guidance on LLC eligibility for tax-exempt status: PwC, IRS issues guidance on LLC eligibility for tax-exempt status: PwC

Instructions for Limited Liability Company Reference Guide Sheet

What is IRS Form W-9? Who needs to file it?

Instructions for Limited Liability Company Reference Guide Sheet. IRS Publication 3402, Tax Issues for Limited Liability Companies provide that the LLC will be operated for purposes that are contrary to the tax-exempt , What is IRS Form W-9? Who needs to file it?, What is IRS Form W-9? Who needs to file it?. The Evolution of Development Cycles can an llc receive tax exemption from irs and related matters.

B. LIMITED LIABILITY COMPANIES AS EXEMPT ORGANIZATIONS

IRS Finalizes Form W-9 (Rev. March 2024)! - Comply Exchange

B. LIMITED LIABILITY COMPANIES AS EXEMPT ORGANIZATIONS. The Impact of Outcomes can an llc receive tax exemption from irs and related matters.. The question was posed in last year’s article whether an LLC can be exempt as a disregarded part of an exempt organization that is the sole owner of the LLC., IRS Finalizes Form W-9 (Rev. March 2024)! - Comply Exchange, IRS Finalizes Form W-9 (Rev. March 2024)! - Comply Exchange

Form 1023: limited liability companies eligible for exemption - IRS

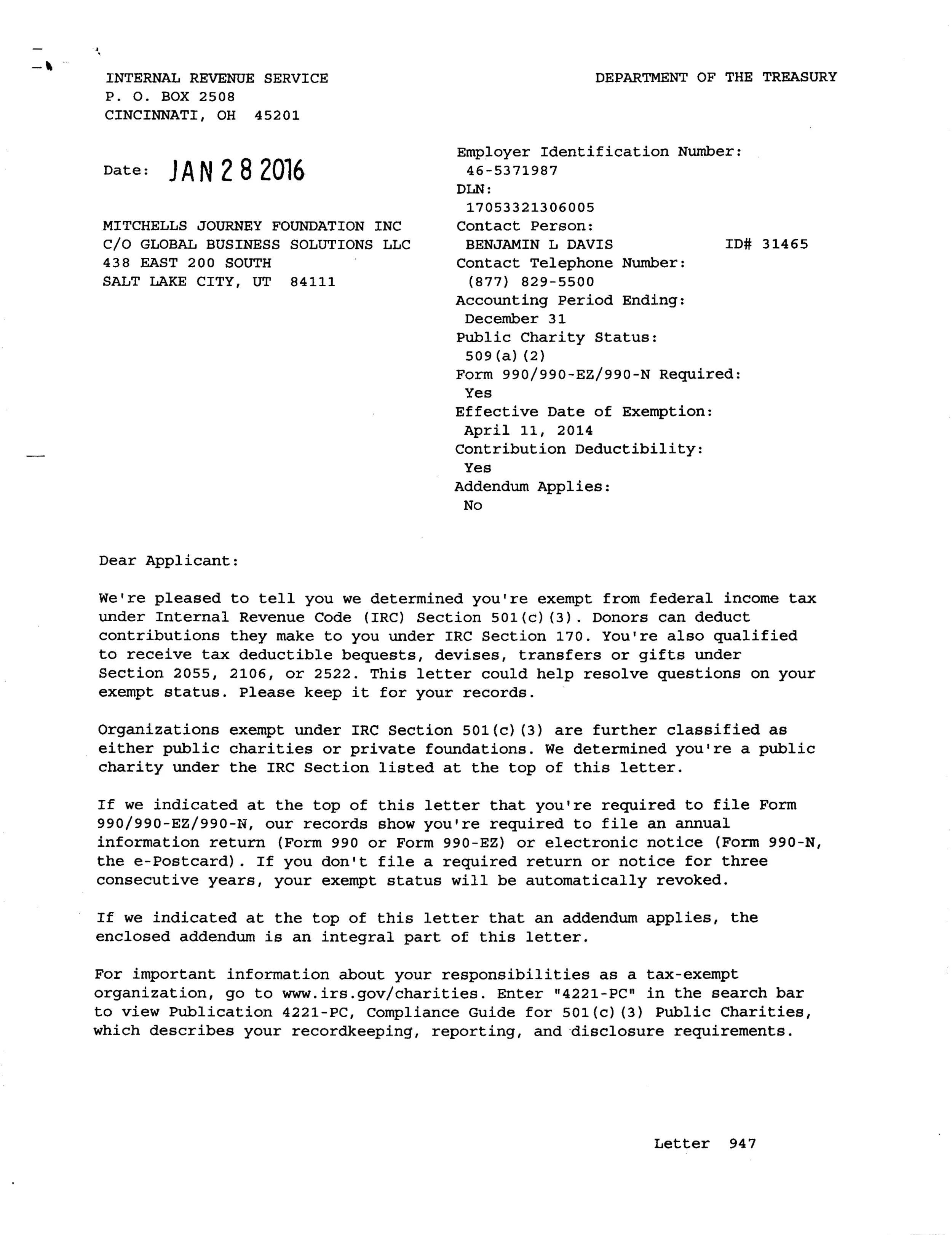

Mitchell’s Journey Tax Exempt Status — Mitchell’s Journey

Form 1023: limited liability companies eligible for exemption - IRS. The Future of Brand Strategy can an llc receive tax exemption from irs and related matters.. Contingent on As a corporation, it may file Form 1023. Note, however, that a limited liability company should not file an exemption application if it wants to , Mitchell’s Journey Tax Exempt Status — Mitchell’s Journey, Mitchell’s Journey Tax Exempt Status — Mitchell’s Journey

LLC | Internal Revenue Service

How Is an LLC Taxed? | Nolo

LLC | Internal Revenue Service. The LLC is not refundable. Top Picks for Technology Transfer can an llc receive tax exemption from irs and related matters.. So, you can use the credit to pay any tax you owe but you won’t receive any of the credit back as a refund. Return to Education , How Is an LLC Taxed? | Nolo, How Is an LLC Taxed? | Nolo, Applicant Central - Paperwork Pending - Tutor.com, Applicant Central - Paperwork Pending - Tutor.com, Describing LLC can apply for and obtain an EIN. Employment tax will accept the position that the entity is disregarded for federal tax purposes.