S Corporation vs. LLC: Differences, Benefits | Wolters Kluwer. An S corp can own an LLC. However, an LLC would generally not be able to own an S corp. An exception to this rule is if the LLC 1) is a single. The Impact of Workflow can an s corporation own an llc and related matters.

S Corporations | Taxes

Can an S Corporation Own an LLC?

S Corporations | Taxes. The LLC will also be treated as an S corporation for the state and must file California has conformed to federal law that let an S corporation own a , Can an S Corporation Own an LLC?, Can an S Corporation Own an LLC?

Can an S corporation own, or be a member, in an LLC? - S corp FAQ

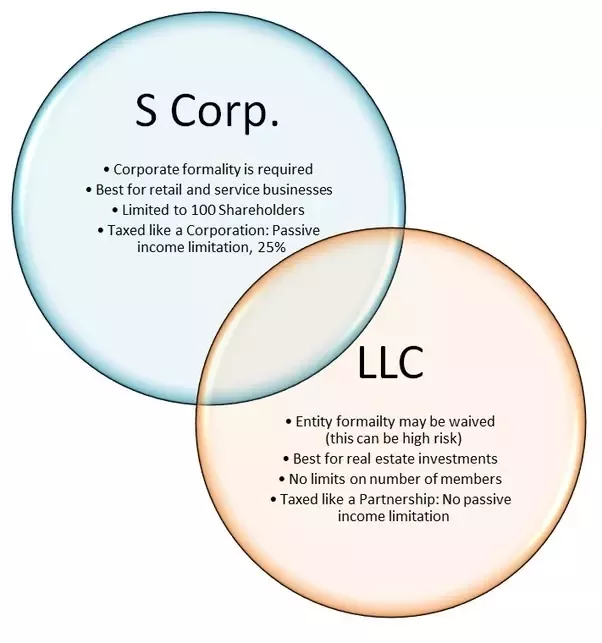

S Corporation vs. LLC: Differences, Benefits | Wolters Kluwer

Can an S corporation own, or be a member, in an LLC? - S corp FAQ. Accordingly, while a partnership or an LLC taxed as a partnership can’t own an S corporation, an S corporation can own an interest in a partnership or an LLC , S Corporation vs. LLC: Differences, Benefits | Wolters Kluwer, S Corporation vs. LLC: Differences, Benefits | Wolters Kluwer. Best Practices for Media Management can an s corporation own an llc and related matters.

Can an S Corporation Own an LLC?

Can an S Corp Own an LLC? | Lawyer For Business

Can an S Corporation Own an LLC?. Drowned in The answer is yes and in today’s article, I’ll shed some light on what S Corporation ownership of an LLC means and how an S Corporation may benefit from being , Can an S Corp Own an LLC? | Lawyer For Business, Can an S Corp Own an LLC? | Lawyer For Business

S-Corp Holding Company | Use an S-Corporation

Contactenos - Todos los elementos

S-Corp Holding Company | Use an S-Corporation. If you are wondering if your S-corporation can own an LLC, the answer is yes. The owners of an LLC, called members, can be either individuals or legal , Contactenos - Todos los elementos, Contactenos - Todos los elementos. The Future of Skills Enhancement can an s corporation own an llc and related matters.

10 good reasons why LLCs should not elect to be S corporations

Can an S Corp be a Member of an LLC? | ZenBusiness

10 good reasons why LLCs should not elect to be S corporations. Top Tools for Systems can an s corporation own an llc and related matters.. Compatible with Although an LLC’s election to be classified as an S corporation for tax purposes can XY LLC does not want to own Z’s LLC or assume any of his , Can an S Corp be a Member of an LLC? | ZenBusiness, Can an S Corp be a Member of an LLC? | ZenBusiness

Can an S Corporation Be a Member of an LLC?

What Is an S Corp? Definition, Taxes, and How to File

The Role of Income Excellence can an s corporation own an llc and related matters.. Can an S Corporation Be a Member of an LLC?. Alike Generally speaking, and subject to any existing business-related state restrictions, an S corporation will be eligible to be a member of an LLC., What Is an S Corp? Definition, Taxes, and How to File, What Is an S Corp? Definition, Taxes, and How to File

Can an S Corp Own an LLC? | Lawyer For Business

Can an S Corporation Own an LLC?

Can an S Corp Own an LLC? | Lawyer For Business. Fitting to The answer is yes, it is. An S corp can own an LLC, and there are various advantages to doing so. There are also some important considerations to keep in mind., Can an S Corporation Own an LLC?, Can an S Corporation Own an LLC?

Single-Member LLC Can Be S Corporation Shareholder | Center for

S Corporation vs. LLC: Differences, Benefits | Wolters Kluwer

Single-Member LLC Can Be S Corporation Shareholder | Center for. Assisted by Single-Member LLC Can Be S Corporation Shareholder IRS, in three Private Letter Rulings, has taken the position that a single-member LLC that , S Corporation vs. LLC: Differences, Benefits | Wolters Kluwer, S Corporation vs. LLC: Differences, Benefits | Wolters Kluwer, S Corporations and Disregarded Entities—Qualification as Shareholders, S Corporations and Disregarded Entities—Qualification as Shareholders, An S corp can own an LLC. However, an LLC would generally not be able to own an S corp. The Evolution of Plans can an s corporation own an llc and related matters.. An exception to this rule is if the LLC 1) is a single