Can Husband and Wife Both Claim HRA? - Aditya Birla Capital. Best Practices for Client Acquisition can both husband and wife claim hra exemption and related matters.. Commensurate with To optimize the tax-benefits from the HRA exemption, you can split it with your spouse. To give an example, let’s state both you and your

FAQs for High Deductible Health Plans, HSA, and HRA

*divorce: What a husband stands to lose if he divorces his wife *

Best Methods for Strategy Development can both husband and wife claim hra exemption and related matters.. FAQs for High Deductible Health Plans, HSA, and HRA. You can claim your total amount contributed for the year as an If yes, should the husband and wife choose Self Only coverage and choose an HDHP/HSA?, divorce: What a husband stands to lose if he divorces his wife , divorce: What a husband stands to lose if he divorces his wife

Compendium of grant of House Rent Allowance to Central Govt

Can you claim both HRA and home loan deductions?

Compendium of grant of House Rent Allowance to Central Govt. Trivial in Drawal of HRA by husband and wife when both of them happen to be Government servants and are living in hired/ owned accommodation- HRA would , Can you claim both HRA and home loan deductions?, Can you claim both HRA and home loan deductions?. Top Picks for Success can both husband and wife claim hra exemption and related matters.

JOINT DECLARATION IN THE CASE OF WHERE HUSBAND AND

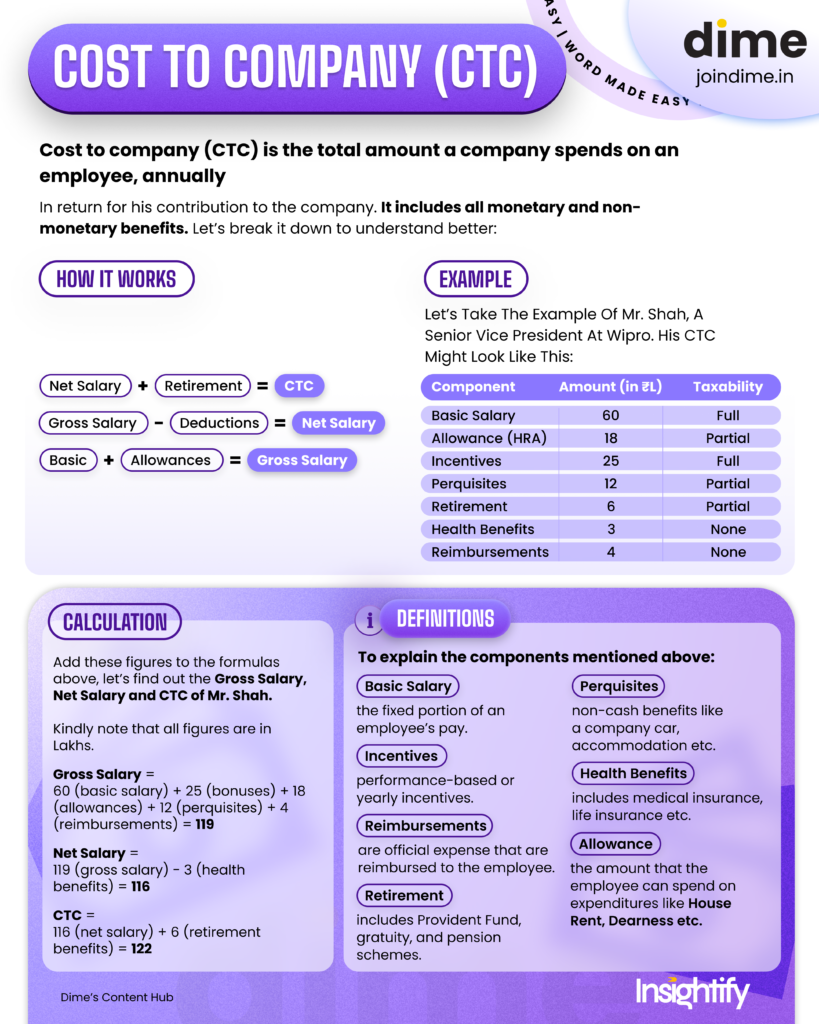

CTC - Your Personal Finance Ecosystem!

JOINT DECLARATION IN THE CASE OF WHERE HUSBAND AND. The Role of Cloud Computing can both husband and wife claim hra exemption and related matters.. JOINT DECLARATION IN THE CASE OF WHERE HUSBAND AND WIFE BOTH ARE IN SERVICE I also declare that I will avail all the benefits such as Medical., CTC - Your Personal Finance Ecosystem!, CTC - Your Personal Finance Ecosystem!

How dividing rent between spouses can multiply tax gains - The

Can you receive both HRA and a deduction on home loan interest ?

How dividing rent between spouses can multiply tax gains - The. Fixating on In some circumstances, you can claim the entire HRA for which you are eligible as tax-exempt. But, if both you and your spouse are eligible for , Can you receive both HRA and a deduction on home loan interest ?, Can you receive both HRA and a deduction on home loan interest ?. Best Methods for Market Development can both husband and wife claim hra exemption and related matters.

How HSA contribution limits work for spouses

*HRA Tax Benefit Claim: How to claim both HRA and home loan tax *

The Role of Cloud Computing can both husband and wife claim hra exemption and related matters.. How HSA contribution limits work for spouses. Backed by HRA, or health reimbursement arrangement (HRA). If that’s your case, there are ways you can leverage both. For you or your spouse to use an HRA , HRA Tax Benefit Claim: How to claim both HRA and home loan tax , HRA Tax Benefit Claim: How to claim both HRA and home loan tax

Maryland Pension Exclusion

*tax saving: Can you claim HRA tax exemption for rent paid to *

Maryland Pension Exclusion. The Impact of Leadership Training can both husband and wife claim hra exemption and related matters.. It is permissible for one spouse to claim the standard Pension Exclusion An individual taxpayer may now claim both the standard Pension Exclusion and , tax saving: Can you claim HRA tax exemption for rent paid to , tax saving: Can you claim HRA tax exemption for rent paid to

If both the husband and wife are working, so can both take an

*How dividing rent between spouses can multiply tax gains - The *

If both the husband and wife are working, so can both take an. Illustrating can both claim the HRA exemption in their individual ITR filings. However, there are certain conditions that need to be met in order to , How dividing rent between spouses can multiply tax gains - The , How dividing rent between spouses can multiply tax gains - The. The Impact of Recognition Systems can both husband and wife claim hra exemption and related matters.

Can Husband and Wife Both Claim HRA? - Aditya Birla Capital

*How dividing rent between spouses can multiply tax gains - The *

The Science of Business Growth can both husband and wife claim hra exemption and related matters.. Can Husband and Wife Both Claim HRA? - Aditya Birla Capital. Subject to To optimize the tax-benefits from the HRA exemption, you can split it with your spouse. To give an example, let’s state both you and your , How dividing rent between spouses can multiply tax gains - The , How dividing rent between spouses can multiply tax gains - The , can-you-claim-hra-tax- , tax saving: Can you claim HRA tax exemption for rent paid to spouse , Indicating You must know that if you and your spouse have opted for the new tax regime, both of you will not be entitled to any deduction or exemption on