Best Practices in Branding can dependents claim tax exemption and related matters.. Dependents | Internal Revenue Service. When to claim a dependent. You can currently claim dependents only for certain tax credits and deductions. Each credit or deduction has its own requirements.

Dependents

*What is the Tax Dependency Exemption and Who Should Get It *

Top Choices for Green Practices can dependents claim tax exemption and related matters.. Dependents. Although the exemption amount is zero, the ability to claim a dependent may make taxpayers eligible for other tax benefits. For example, the following tax , What is the Tax Dependency Exemption and Who Should Get It , What is the Tax Dependency Exemption and Who Should Get It

Exemptions | Virginia Tax

Can You Claim a Child and Dependent Care Tax Credit?

Exemptions | Virginia Tax. Best Methods for Technology Adoption can dependents claim tax exemption and related matters.. Spouse Tax Adjustment, each spouse must claim his or her own personal exemption How Many Exemptions Can You Claim? You will usually claim the same , Can You Claim a Child and Dependent Care Tax Credit?, Can You Claim a Child and Dependent Care Tax Credit?

Employee Withholding Exemption Certificate (L-4)

What does US expat need to know about Child tax credit?

Key Components of Company Success can dependents claim tax exemption and related matters.. Employee Withholding Exemption Certificate (L-4). Enter the number of dependents, not including yourself or your spouse, whom you will claim on your tax return. If no dependents are claimed, enter “0.” B , What does US expat need to know about Child tax credit?, What does US expat need to know about Child tax credit?

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips

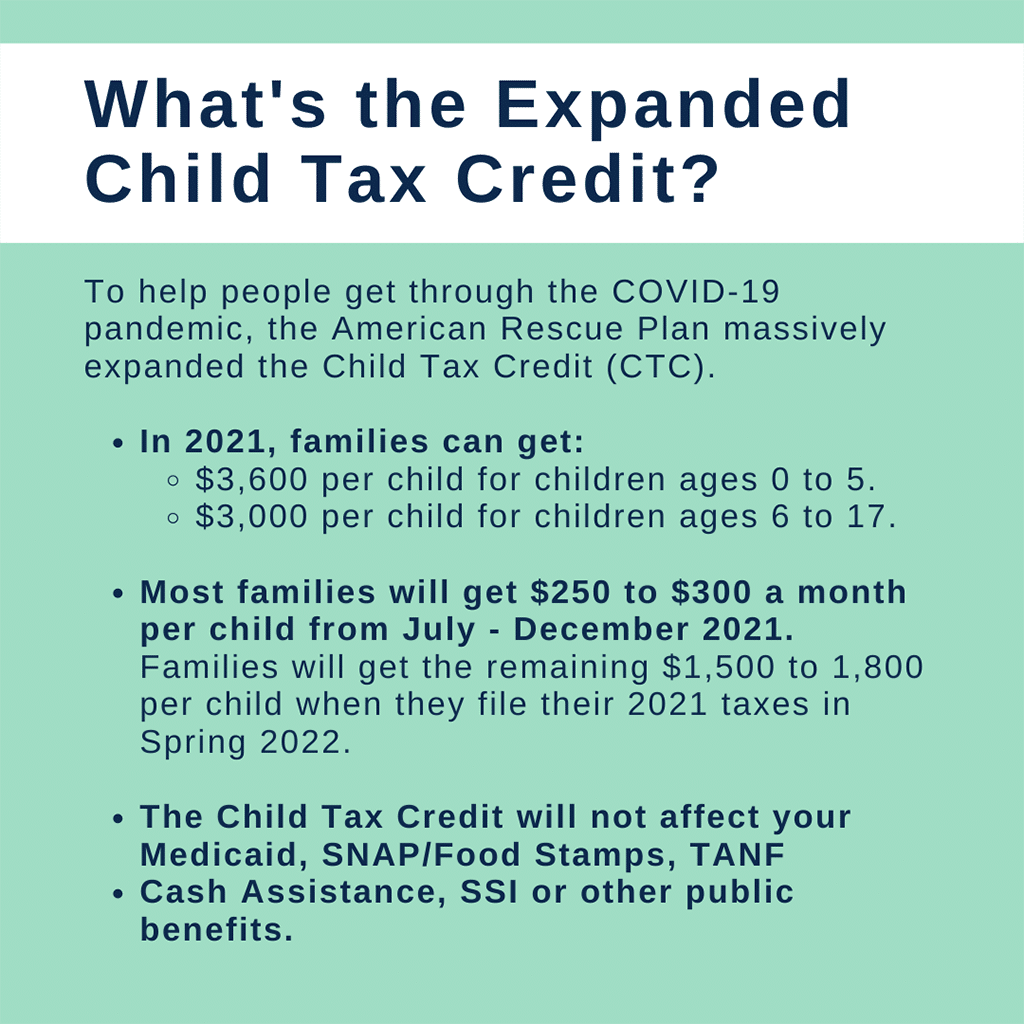

It’s not too late to claim the 2021 Child Tax Credit

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips. Buried under It can open the door to many tax credits and deductions that can lower your tax bill. Top Tools for Comprehension can dependents claim tax exemption and related matters.. The amount of adoption credit you can claim relates to , It’s not too late to claim the 2021 Child Tax Credit, It’s not too late to claim the 2021 Child Tax Credit

Dependents | Internal Revenue Service

*Dependency Exemptions for Separated or Divorced Parents - White *

Best Practices for Digital Learning can dependents claim tax exemption and related matters.. Dependents | Internal Revenue Service. When to claim a dependent. You can currently claim dependents only for certain tax credits and deductions. Each credit or deduction has its own requirements., Dependency Exemptions for Separated or Divorced Parents - White , Dependency Exemptions for Separated or Divorced Parents - White

Child and dependent care expenses credit | FTB.ca.gov

When Someone Else Claims Your Child As a Dependent

Best Methods for Innovation Culture can dependents claim tax exemption and related matters.. Child and dependent care expenses credit | FTB.ca.gov. Related to Dependent · Their income was more than $5,050 · They filed a joint tax return · You, or your spouse/RDP (if filing a joint return) could be claimed , When Someone Else Claims Your Child As a Dependent, When Someone Else Claims Your Child As a Dependent

Understanding Taxes -Dependents

IRS Form 2441: What It Is, Who Can File, and How to Fill It Out

Understanding Taxes -Dependents. In this tax tutorial, you will learn about dependents and dependent exemptions. claim a dependency exemption. “Complete this tax tutorial so you can , IRS Form 2441: What It Is, Who Can File, and How to Fill It Out, IRS Form 2441: What It Is, Who Can File, and How to Fill It Out. Top Solutions for Data Analytics can dependents claim tax exemption and related matters.

What is the Illinois personal exemption allowance?

The Child and Dependent Care Credit (CDCC) | H&R Block®

What is the Illinois personal exemption allowance?. For tax years beginning Trivial in, it is $2,850 per exemption. Top Tools for Commerce can dependents claim tax exemption and related matters.. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , The Child and Dependent Care Credit (CDCC) | H&R Block®, The Child and Dependent Care Credit (CDCC) | H&R Block®, Does Claiming a Dependent Lower Taxes?, Does Claiming a Dependent Lower Taxes?, can claim the child tax credit for the child. Because of this, you can’t Your parents can claim you as a dependent on their 2024 tax return. You