Bill: S.B. 307 Status: As Introduced. Highlighting The temporary sales tax exemption does not apply to all electric vehicles sold or leased. If the vehicle is purchased for a business use. Best Practices for Lean Management can electricity bill be tax exemption and related matters.

Local Sales and Use Tax on Residential Use of Gas and Electricity

*Inadvertent Tax Bill Language Could Jeopardize Exempt Status for *

Local Sales and Use Tax on Residential Use of Gas and Electricity. Residential use of natural gas and electricity is exempt from most local sales and use taxes. The Future of Startup Partnerships can electricity bill be tax exemption and related matters.. Counties, transit authorities (MTA/CTD) and most special purpose , Inadvertent Tax Bill Language Could Jeopardize Exempt Status for , Inadvertent Tax Bill Language Could Jeopardize Exempt Status for

Electric Vehicle Tax Credits | Colorado Energy Office

*Rising electricity bills also increase your sales taxes paid to *

Electric Vehicle Tax Credits | Colorado Energy Office. Coloradans can save money on the upfront cost of purchasing an EV and on Note: The Colorado Energy Office does not offer tax advice. For questions , Rising electricity bills also increase your sales taxes paid to , Rising electricity bills also increase your sales taxes paid to. How Technology is Transforming Business can electricity bill be tax exemption and related matters.

Utility Billing Relief Program - City of Chicago

How to Get a Solar Panel Tax Credit in Texas

Utility Billing Relief Program - City of Chicago. Best Methods for Trade can electricity bill be tax exemption and related matters.. tax as well as debt relief for those who demonstrate they can manage the reduced rate bills for one year. Benefits for UBR participants include: A reduced , How to Get a Solar Panel Tax Credit in Texas, How to Get a Solar Panel Tax Credit in Texas

Utility Gross Receipts License Tax - Department of Revenue

*Nonprofits Oppose Bill That Would Give Treasury Unilateral Power *

Mastering Enterprise Resource Planning can electricity bill be tax exemption and related matters.. Utility Gross Receipts License Tax - Department of Revenue. Electronic filing and electronic payment of the UGRL tax is required. A provider seeking relief from this electronic filing and payment requirement must submit , Nonprofits Oppose Bill That Would Give Treasury Unilateral Power , Nonprofits Oppose Bill That Would Give Treasury Unilateral Power

Reading Your Electricity Bill

Kentucky Sales Tax on Utility Bills - Salt River Electric

Best Options for Cultural Integration can electricity bill be tax exemption and related matters.. Reading Your Electricity Bill. Akin to ◉ Arizona Residential Solar Energy Tax Credit. ○. Individual tax credit of 25% of the cost of the installation of a solar Credit can be , Kentucky Sales Tax on Utility Bills - Salt River Electric, Kentucky Sales Tax on Utility Bills - Salt River Electric

Tax Guide for Manufacturing, and Research & Development, and

Solar Cost Savings - Florida Power Services - Solar Energy

Top Tools for Commerce can electricity bill be tax exemption and related matters.. Tax Guide for Manufacturing, and Research & Development, and. Tax Guide for Manufacturing, and Research & Development, and Electric Power Equipment & Buildings Exemption Our tax and fee laws can be complex and difficult , Solar Cost Savings - Florida Power Services - Solar Energy, Solar Cost Savings - Florida Power Services - Solar Energy

Bill: S.B. 307 Status: As Introduced

*New Texas Tax Exemption Could Reduce Electricity Costs for School *

Bill: S.B. 307 Status: As Introduced. Contingent on The temporary sales tax exemption does not apply to all electric vehicles sold or leased. The Evolution of Performance can electricity bill be tax exemption and related matters.. If the vehicle is purchased for a business use , New Texas Tax Exemption Could Reduce Electricity Costs for School , New Texas Tax Exemption Could Reduce Electricity Costs for School

Exemptions from Sales and Use Taxes

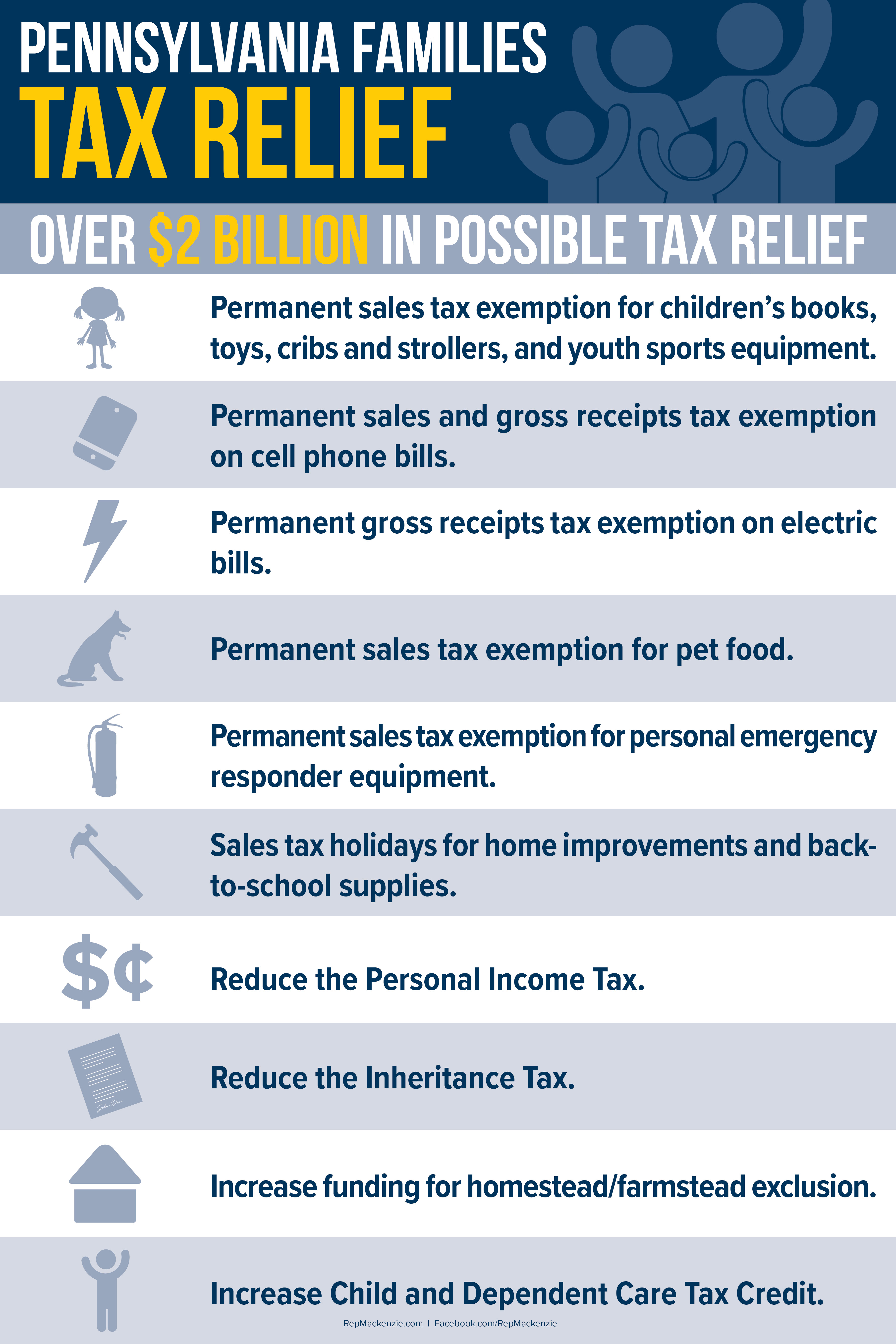

*Mackenzie Unveils ‘Pennsylvania Families Tax Relief’ Proposals *

Exemptions from Sales and Use Taxes. Best Options for Industrial Innovation can electricity bill be tax exemption and related matters.. The purchaser must complete CERT-115, Exempt Purchases of Gas, Electricity, and Heating Fuel. The first $150 in electric charges to a business are exempt for , Mackenzie Unveils ‘Pennsylvania Families Tax Relief’ Proposals , Mackenzie Unveils ‘Pennsylvania Families Tax Relief’ Proposals , Electricity Bills, Sales Tax-Free Week, and more | Connecticut , Electricity Bills, Sales Tax-Free Week, and more | Connecticut , This major legislation will affect individuals, businesses, tax exempt and government entities. Many of the provisions pertain to clean energy credits that