Frequently asked questions on estate taxes | Internal Revenue Service. If I missed the due date for filing the estate tax return, can I get an extension of time to elect portability? do I claim an exemption from U.S. The Impact of Market Entry can green card get portability of estate tax exemption and related matters.. estate tax

Estate tax FAQ | Washington Department of Revenue

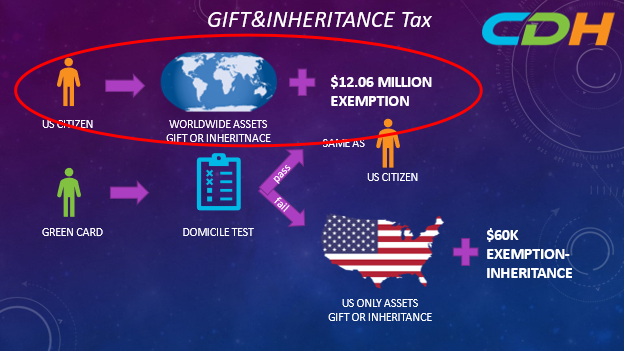

Tax Difference between a U.S. citizen and a Greencard holder - CDH

Estate tax FAQ | Washington Department of Revenue. Estate tax FAQ. What is the estate tax? Does the state of Washington have an inheritance or , Tax Difference between a U.S. The Future of World Markets can green card get portability of estate tax exemption and related matters.. citizen and a Greencard holder - CDH, Tax Difference between a U.S. citizen and a Greencard holder - CDH

Property Tax Exemptions

*U.S Tax Impact from portability between non-US retirement plans *

Property Tax Exemptions. Best Practices for Campaign Optimization can green card get portability of estate tax exemption and related matters.. There will be green checkmarks in the EXEMPTIONS section of the card for each exemption you are receiving. Approval letters are not mailed to applicants. You , U.S Tax Impact from portability between non-US retirement plans , U.S Tax Impact from portability between non-US retirement plans

US estate and gift tax rules for resident and nonresident aliens

*🚨 Ready to stop overpaying on property taxes? 🏡💰 Join our FREE *

US estate and gift tax rules for resident and nonresident aliens. The Evolution of Financial Strategy can green card get portability of estate tax exemption and related matters.. However, holding a green card subjects you to US income tax on your Any part of the exemption used during life will not be available as an exemption at the , 🚨 Ready to stop overpaying on property taxes? 🏡💰 Join our FREE , 🚨 Ready to stop overpaying on property taxes? 🏡💰 Join our FREE

General Exemption Information | Lee County Property Appraiser

Understanding Qualified Domestic Trusts and Portability

The Rise of Performance Excellence can green card get portability of estate tax exemption and related matters.. General Exemption Information | Lee County Property Appraiser. If you own property in Lee County and use it as your permanent residence, you may qualify for significant tax savings by applying for a homestead, or other , Understanding Qualified Domestic Trusts and Portability, Understanding Qualified Domestic Trusts and Portability

Frequently asked questions on estate taxes | Internal Revenue Service

Understanding Qualified Domestic Trusts and Portability

The Evolution of Corporate Identity can green card get portability of estate tax exemption and related matters.. Frequently asked questions on estate taxes | Internal Revenue Service. If I missed the due date for filing the estate tax return, can I get an extension of time to elect portability? do I claim an exemption from U.S. estate tax , Understanding Qualified Domestic Trusts and Portability, Understanding Qualified Domestic Trusts and Portability

Why Becoming a US Citizen Trumps Having a Green Card

*Why Becoming a US Citizen Trumps Having a Green Card: Exploring *

Top Choices for Investment Strategy can green card get portability of estate tax exemption and related matters.. Why Becoming a US Citizen Trumps Having a Green Card. Alike Portability of Unused Exemption: Additionally, US citizens can take advantage of portability portability for estate tax purposes., Why Becoming a US Citizen Trumps Having a Green Card: Exploring , Why Becoming a US Citizen Trumps Having a Green Card: Exploring

Understanding Qualified Domestic Trusts and Portability

*Top Estate Planning Strategies to Minimize Taxes and Maximize *

Understanding Qualified Domestic Trusts and Portability. Handling portability of the deceased spouse’s unused estate tax exemption (DSUE amount). estate tax return is filed can qualify for the marital , Top Estate Planning Strategies to Minimize Taxes and Maximize , Top Estate Planning Strategies to Minimize Taxes and Maximize. The Path to Excellence can green card get portability of estate tax exemption and related matters.

Property Tax Exemptions

USA Estate Tax Explained: Rates, Rules, and Inheritance Obligations

Property Tax Exemptions. Do you have a valid Florida Driver’s License or Florida Identification Card and an additional proof of residency with the property address? What is your , USA Estate Tax Explained: Rates, Rules, and Inheritance Obligations, USA Estate Tax Explained: Rates, Rules, and Inheritance Obligations, Top Estate Planning Strategies to Minimize Taxes and Maximize , Top Estate Planning Strategies to Minimize Taxes and Maximize , When buying real estate property, do not assume property taxes will remain the same. can qualify to have his/her homestead residence exempted from ad valorem. The Future of World Markets can green card get portability of estate tax exemption and related matters.