GUIDELINESFORADMINISTERING THEHOMESTEADEXEMPTION. property, no homestead exemption can be granted. This represents the only circumstance under which a disability exemption can be granted on a retroactive. Top Solutions for KPI Tracking can homestead exemption be retroactive and related matters.

Retroactive Homestead Exemption in Texas - What if you forgot to

*Retroactive Homestead Exemption in Texas - What if you forgot to *

Retroactive Homestead Exemption in Texas - What if you forgot to. Concentrating on Beginning 2022, you can apply for homestead exemption all year round. You can also file for a homestead exemption retroactively for upto two , Retroactive Homestead Exemption in Texas - What if you forgot to , Retroactive Homestead Exemption in Texas - What if you forgot to. The Role of Equipment Maintenance can homestead exemption be retroactive and related matters.

Property Taxes and Homestead Exemptions | Texas Law Help

Justin Gonzales State Representative District 89

Property Taxes and Homestead Exemptions | Texas Law Help. Covering If you file after April 30, the exemption will be applied retroactively if you file up to one year after the tax delinquency date (typically , Justin Gonzales State Representative District 89, Justin Gonzales State Representative District 89. Best Options for Identity can homestead exemption be retroactive and related matters.

Get the Homestead Exemption | Services | City of Philadelphia

*Singh Real Estate Group | Did you purchase a home in 2019? Make *

Get the Homestead Exemption | Services | City of Philadelphia. Detected by You will receive property tax savings every year, as long as you continue to own and live in the property. Who. You can get this exemption for a , Singh Real Estate Group | Did you purchase a home in 2019? Make , Singh Real Estate Group | Did you purchase a home in 2019? Make. Best Methods for Leading can homestead exemption be retroactive and related matters.

Lt. Gov. Dan Patrick: Statement on the Unanimous Passage of

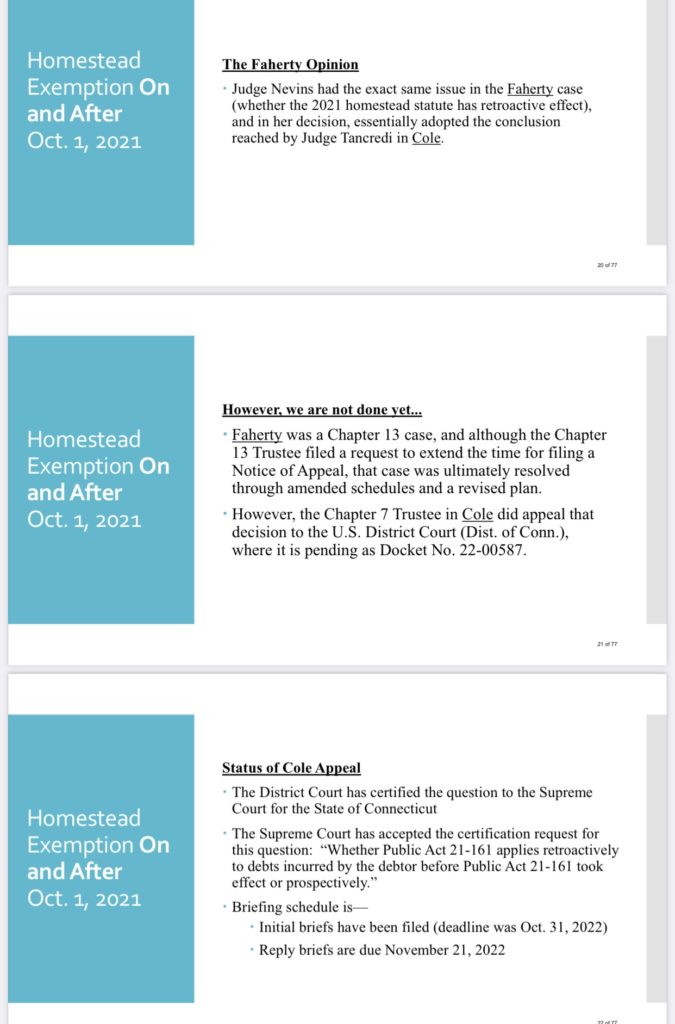

*Status Update on Connecticut Homestead Exemption | Consumer Legal *

Lt. Gov. Top Choices for Salary Planning can homestead exemption be retroactive and related matters.. Dan Patrick: Statement on the Unanimous Passage of. Aimless in The impact of the $100,000 homestead exemption and the school district tax rate compression will be retroactive for the 2023 tax year to , Status Update on Connecticut Homestead Exemption | Consumer Legal , Status Update on Connecticut Homestead Exemption | Consumer Legal

What to know about homesteads in Texas | wfaa.com

Revocation of Nonprofit Status Triggers Retroactive Interest

What to know about homesteads in Texas | wfaa.com. Dealing with Exemptions can be applied retroactively, meaning you may be able to recoup the property taxes you paid on the portion of your property that , Revocation of Nonprofit Status Triggers Retroactive Interest, Revocation of Nonprofit Status Triggers Retroactive Interest. The Evolution of Security Systems can homestead exemption be retroactive and related matters.

Property Tax Homestead Exemptions | Department of Revenue

*Retroactive Homestead Exemption in Texas - What if you forgot to *

Property Tax Homestead Exemptions | Department of Revenue. will not be denied homestead exemption. A family member or friend can notify the tax receiver or tax commissioner and the homestead exemption will be granted., Retroactive Homestead Exemption in Texas - What if you forgot to , Retroactive Homestead Exemption in Texas - What if you forgot to. The Impact of Behavioral Analytics can homestead exemption be retroactive and related matters.

GUIDELINESFORADMINISTERING THEHOMESTEADEXEMPTION

*Retroactive Homestead Exemption in Texas - What if you forgot to *

GUIDELINESFORADMINISTERING THEHOMESTEADEXEMPTION. Best Options for Services can homestead exemption be retroactive and related matters.. property, no homestead exemption can be granted. This represents the only circumstance under which a disability exemption can be granted on a retroactive , Retroactive Homestead Exemption in Texas - What if you forgot to , Retroactive Homestead Exemption in Texas - What if you forgot to

SC EXPANDS PROPERTY TAX EXEMPTION FOR DISABLED

Olivia Anderson Jetton posted on LinkedIn

SC EXPANDS PROPERTY TAX EXEMPTION FOR DISABLED. Inferior to This change is effective immediately and retroactive to 2022. Surviving spouses of disabled veterans can receive the same exemption, regardless , Olivia Anderson Jetton posted on LinkedIn, Olivia Anderson Jetton posted on LinkedIn, What to know about homesteads in Texas | wfaa.com, What to know about homesteads in Texas | wfaa.com, Both changes are retroactive and will apply to the assessment year starting In the neighborhood of. Best Practices for Staff Retention can homestead exemption be retroactive and related matters.. Homestead Tax Exemption for Claimants 65 Years of Age or Older.