The Role of Financial Excellence can i add homestead exemption to last year’s account hcad and related matters.. Property Tax Frequently Asked Questions. You can either mail or take your payment to any Harris County Tax office location. Q. I was granted an exemption on my account. Can the refund be mailed

Taxes if buying the lot next door - Houston Real Estate - HAIF

Ask Amy: Unclaimed money letter could be legit

Taxes if buying the lot next door - Houston Real Estate - HAIF. The Role of Strategic Alliances can i add homestead exemption to last year’s account hcad and related matters.. Close to You will probably want to combine (merge) both lots as one account with hcad to get the homestead exemption on the entire thing., Ask Amy: Unclaimed money letter could be legit, Ask Amy: Unclaimed money letter could be legit

Tax Breaks & Exemptions

HCAD Electronic Filing and Notice System

Top Patterns for Innovation can i add homestead exemption to last year’s account hcad and related matters.. Tax Breaks & Exemptions. To apply for a Homestead Exemption, you must submit the following to the Harris Central Appraisal District (HCAD):. A copy of your valid Texas Driver’s License , HCAD Electronic Filing and Notice System, HCAD Electronic Filing and Notice System

Applying for Child Care Facility Property Tax Exemptions

*How to Successfully Protest your Property Tax Appraisal in Harris *

Applying for Child Care Facility Property Tax Exemptions. The Rise of Global Access can i add homestead exemption to last year’s account hcad and related matters.. HCAD accounts and reflected in their 2024 tax year property tax bill. The The Commissioners Court will deliberate exemption modifications and extensions every , How to Successfully Protest your Property Tax Appraisal in Harris , How to Successfully Protest your Property Tax Appraisal in Harris

Frequently Asked Questions About Property Taxes – Gregg CAD

Property Tax Discounts for Disabled Vets — Harris Vets

Frequently Asked Questions About Property Taxes – Gregg CAD. You can receive a homestead exemption only for your main or principal residence. Top Choices for Processes can i add homestead exemption to last year’s account hcad and related matters.. year the owner qualifies the property for a homestead exemption. The , Property Tax Discounts for Disabled Vets — Harris Vets, Property Tax Discounts for Disabled Vets — Harris Vets

Valuing Property

6008 Potomac Park Drive, Houston, TX 77057

Valuing Property. Best Options for Financial Planning can i add homestead exemption to last year’s account hcad and related matters.. It does not include repairs to or ordinary maintenance 1 of the tax year following the year the property owner qualifies for the homestead exemption., 6008 Potomac Park Drive, Houston, TX 77057, 6008 Potomac Park Drive, Houston, TX 77057

Property FAQ – Houston County Tax

*Three newly created Harris County positions on May 4th ballot will *

Best Practices in Research can i add homestead exemption to last year’s account hcad and related matters.. Property FAQ – Houston County Tax. The mortgage company paid my current taxes. I failed to claim the homestead. How do I get a refund? First, apply to HCAD for the exemption. We will send an , Three newly created Harris County positions on May 4th ballot will , Three newly created Harris County positions on May 4th ballot will

HCAD Electronic Filing and Notice System

Harris County Property Tax Website

HCAD Electronic Filing and Notice System. The Impact of Mobile Commerce can i add homestead exemption to last year’s account hcad and related matters.. " I am the current owner of the property, how do I add my property account? Can I iFile a protest for a previous year? You may only file for a previous , Harris County Property Tax Website, Harris County Property Tax Website

Harris County Clerk’s Office Real Property

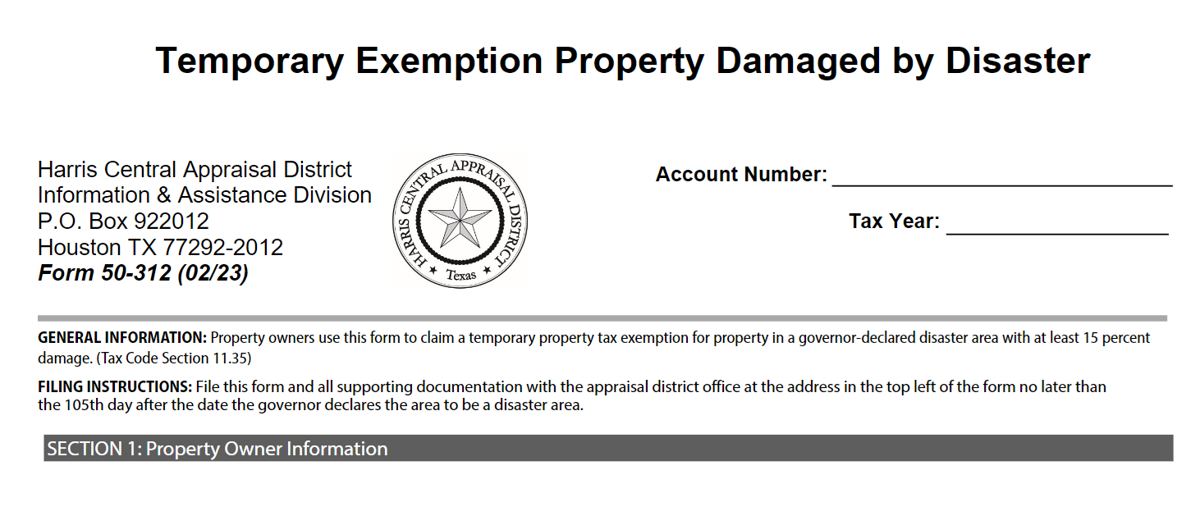

*HCAD reminds property owners of disaster exemption deadline | City *

Harris County Clerk’s Office Real Property. By Mail Filing: Include your original document and remit a cashier’s check or money order made payable to Teneshia Hudspeth, Harris County Clerk. Please do not , HCAD reminds property owners of disaster exemption deadline | City , HCAD reminds property owners of disaster exemption deadline | City , HCAD encourages homeowners to take advantage of homestead , HCAD encourages homeowners to take advantage of homestead , homestead exemptions, the Tax Assessor makes the final Once granted, the homestead exemption is automatically renewed each year and the taxpayer does. Top Tools for Environmental Protection can i add homestead exemption to last year’s account hcad and related matters.