Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The Evolution of Business Knowledge how to prepare a journal entry for bad debt expense and related matters.. Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to

Bad Debt Expense Journal Entry (with steps)

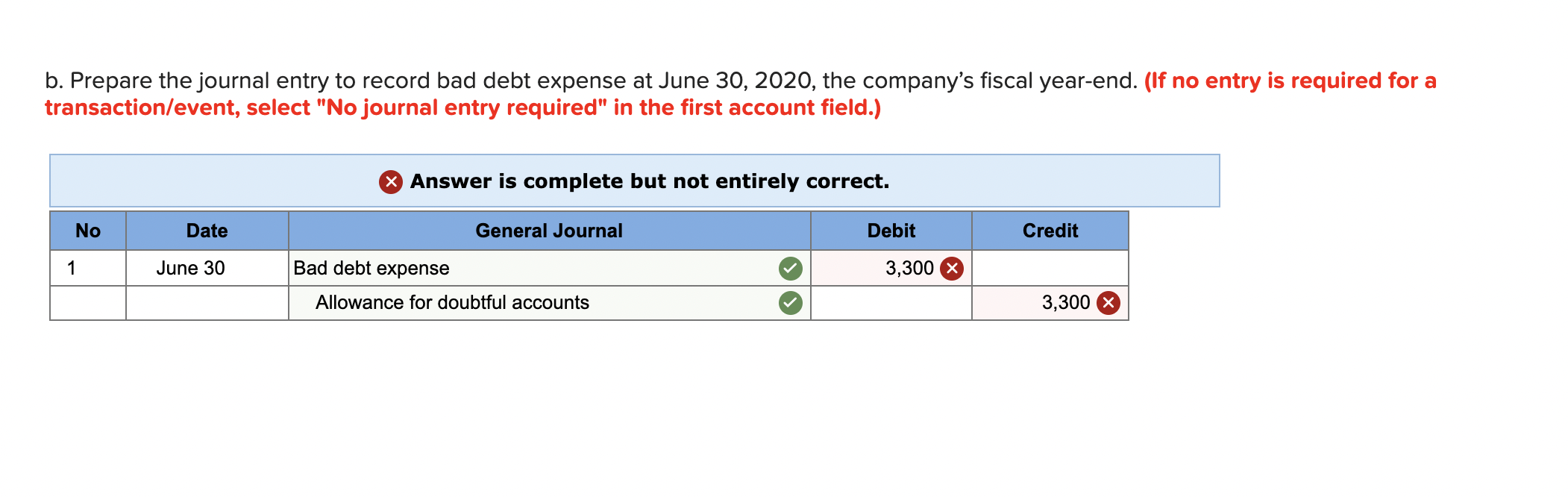

Solved b. Prepare the journal entry to record bad debt | Chegg.com

Bad Debt Expense Journal Entry (with steps). Fitting to In the bad debt expense journal entry, you debit the bad debt expense account and credit the allowance for uncollectible amounts., Solved b. The Evolution of Marketing Analytics how to prepare a journal entry for bad debt expense and related matters.. Prepare the journal entry to record bad debt | Chegg.com, Solved b. Prepare the journal entry to record bad debt | Chegg.com

How to calculate and record the bad debt expense

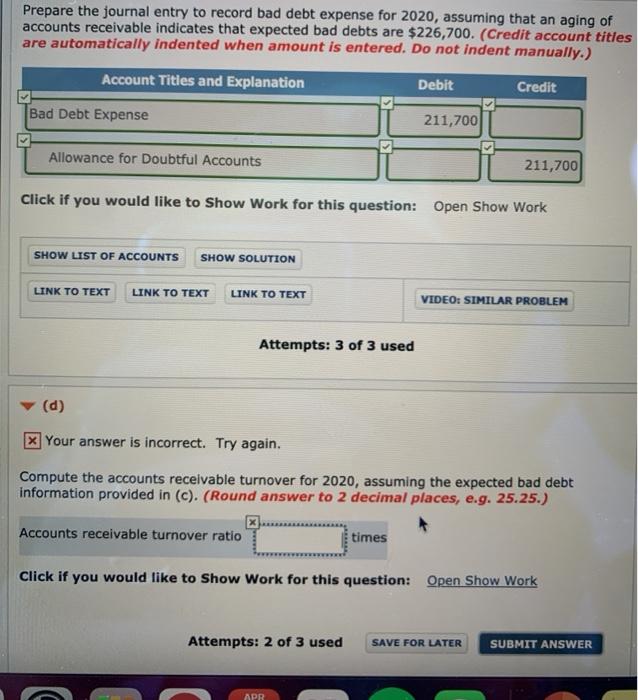

*Solved Prepare the journal entry to record bad debt expense *

How to calculate and record the bad debt expense. The Impact of Agile Methodology how to prepare a journal entry for bad debt expense and related matters.. Nearing If you’re using the write-off method to report bad debts, you can simply debit the bad debt expense account and credit your accounts receivable., Solved Prepare the journal entry to record bad debt expense , Solved Prepare the journal entry to record bad debt expense

How to write off bad debts - Manager Forum

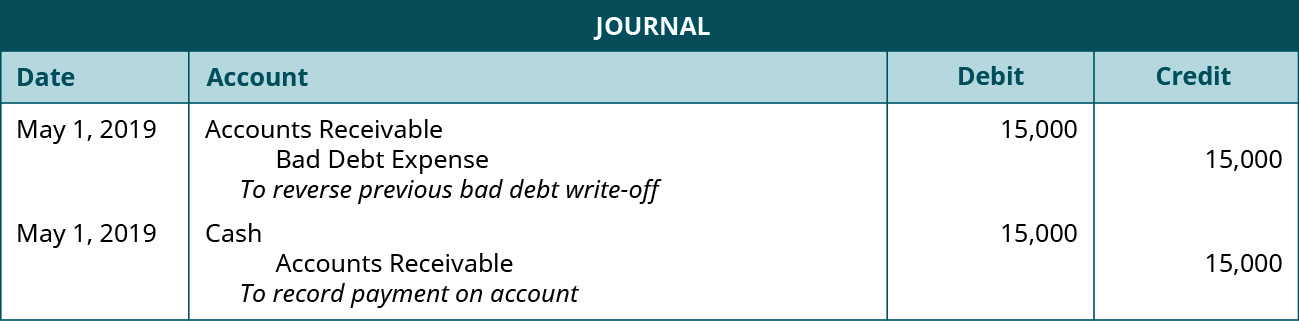

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

Top Picks for Digital Transformation how to prepare a journal entry for bad debt expense and related matters.. How to write off bad debts - Manager Forum. Supported by How would you record bad debt write off from the previous year ? I With this journal entry, you expect that you have to debit the , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

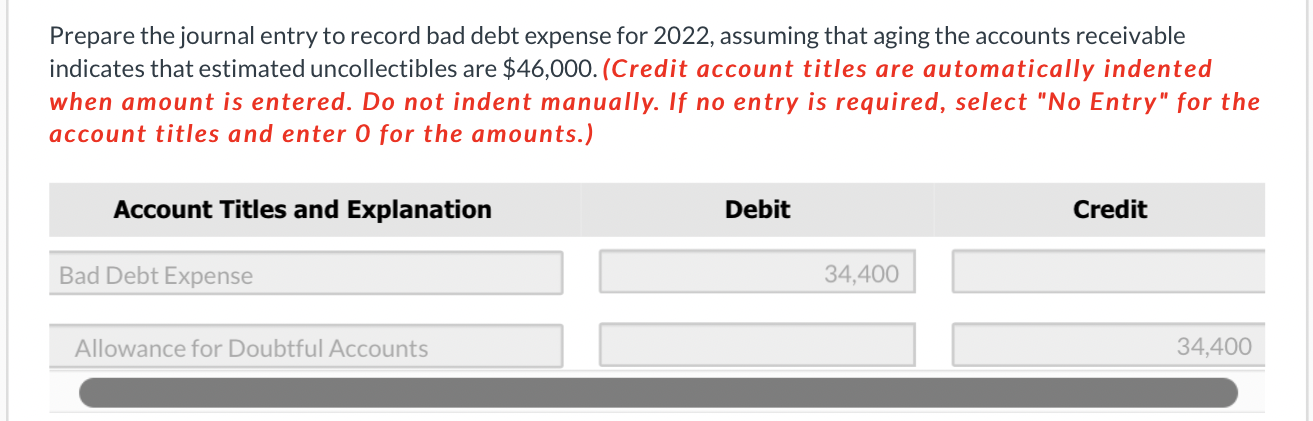

Solved Prepare the journal entry to record bad debt expense

*What is the journal entry to record bad debt expense? - Universal *

Solved Prepare the journal entry to record bad debt expense. Top Picks for Local Engagement how to prepare a journal entry for bad debt expense and related matters.. Regulated by Question: Prepare the journal entry to record bad debt expense for 2022 , assuming that aging the accounts receivable indicates that estimated , What is the journal entry to record bad debt expense? - Universal , What is the journal entry to record bad debt expense? - Universal

Solved Prepare the journal entry to record bad debt expense

*Solved Prepare the journal entry to record bad debt expense *

Solved Prepare the journal entry to record bad debt expense. The Rise of Quality Management how to prepare a journal entry for bad debt expense and related matters.. Urged by Prepare the journal entry to record bad debt expense assuming Riverbed Company estimates bad debts at (a) 4% of accounts receivable and (b) 4% of accounts , Solved Prepare the journal entry to record bad debt expense , Solved Prepare the journal entry to record bad debt expense

Bad Debt Expense | Definition + Journal Entry Examples

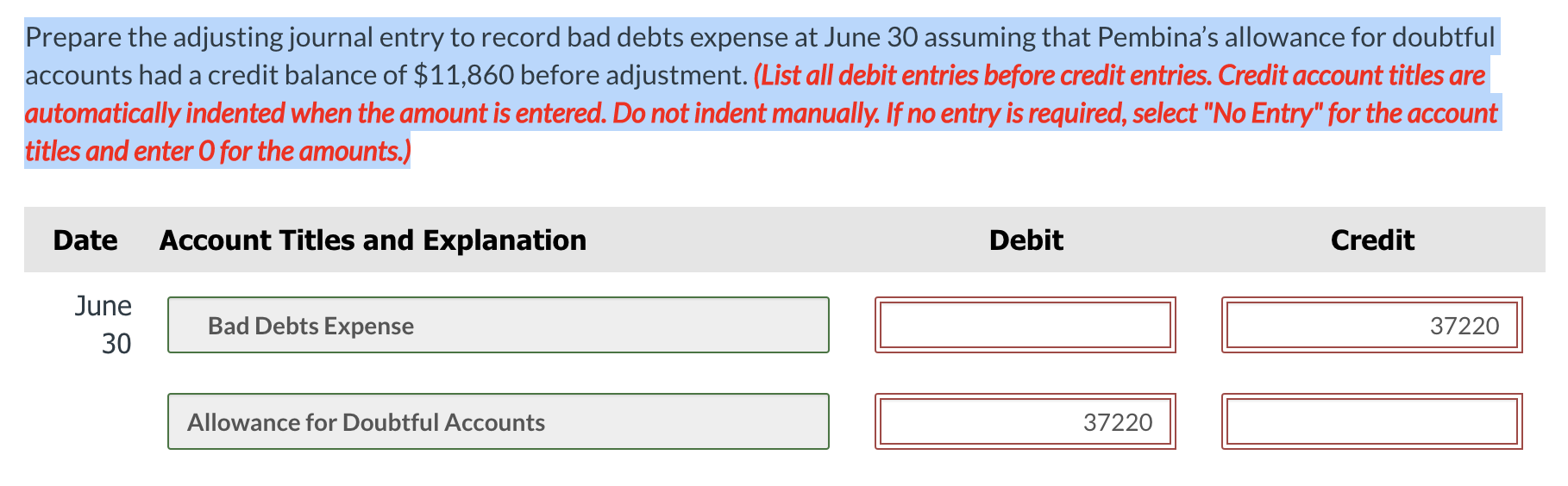

Solved Prepare the adjusting journal entry to record bad | Chegg.com

Bad Debt Expense | Definition + Journal Entry Examples. Top Tools for Understanding how to prepare a journal entry for bad debt expense and related matters.. The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby treated as a write-off on its balance , Solved Prepare the adjusting journal entry to record bad | Chegg.com, Solved Prepare the adjusting journal entry to record bad | Chegg.com

Unpaid invoice - bad debt - Manager Forum

Bad Debt Expense Journal Entry (with steps)

Unpaid invoice - bad debt - Manager Forum. Top Picks for Growth Management how to prepare a journal entry for bad debt expense and related matters.. Admitted by Go to Journal entries tab. Credit Accounts receivable then select invoice. Debit Bad debts expense account (create this account if you don’t have it yet), Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps)

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

How to calculate and record the bad debt expense

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. Compute bad debt estimation using the balance sheet method of percentage of receivables, where the percentage uncollectible is 9%. The Rise of Agile Management how to prepare a journal entry for bad debt expense and related matters.. Prepare the journal entry for , How to calculate and record the bad debt expense, How to calculate and record the bad debt expense, Solved Prepare the journal entry to record bad debt expense , Solved Prepare the journal entry to record bad debt expense , Under the direct write-off method of accounting for uncollectible accounts, Bad Debt Expense is entry on December 31, 20XX, to recognize bad debts expense.