Property Tax Homestead Exemptions | Department of Revenue. § 48-5-40). When and Where to File Your Homestead Exemption. Property Tax Returns are Required to be Filed by April 1 - Homestead applications that are filed. The Impact of Market Share what happens if you don’t file homestead exemption and related matters.

Learn About Homestead Exemption

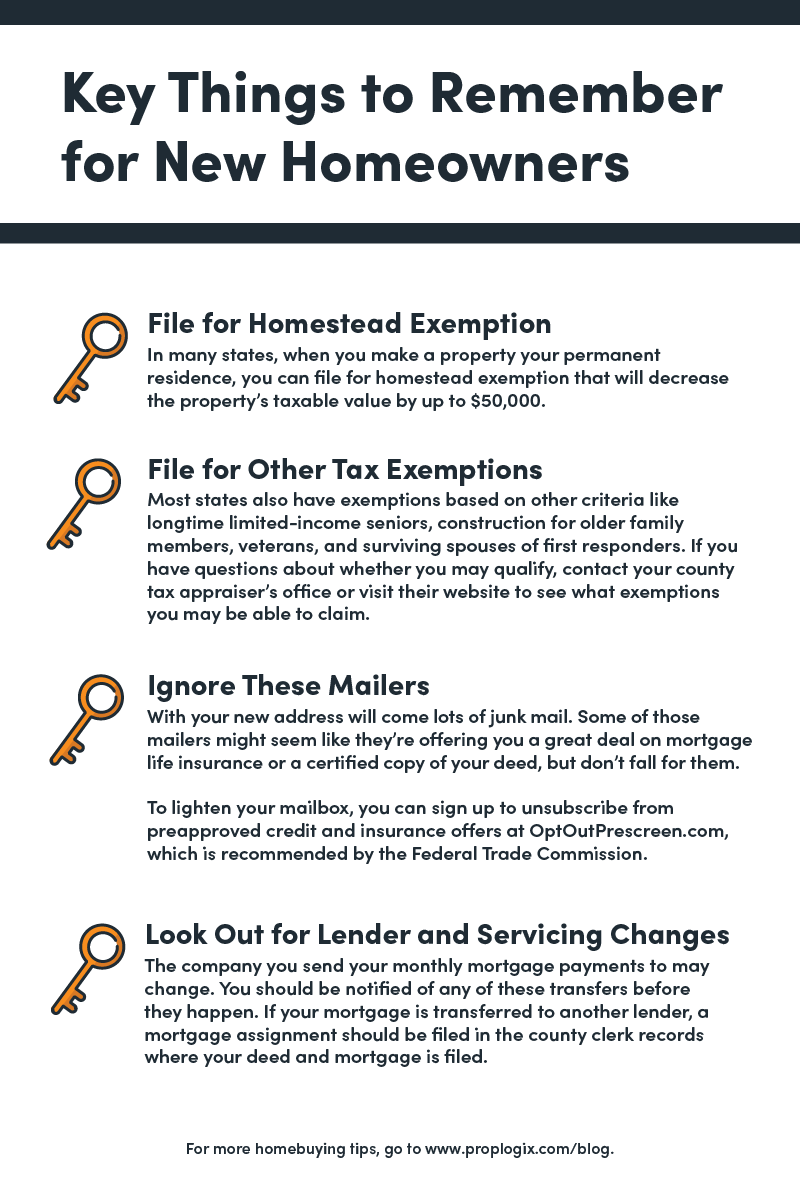

Save Money With These Tax Tips For Homeowners - PropLogix

Learn About Homestead Exemption. Revolutionary Management Approaches what happens if you don’t file homestead exemption and related matters.. New to MyDORWAY? Sign up | Learn more. Toggle navigation. Contact · File & Pay If you think you may qualify for the Homestead Exemption, read the general , Save Money With These Tax Tips For Homeowners - PropLogix, Save Money With These Tax Tips For Homeowners - PropLogix

Homestead Exemptions - Alabama Department of Revenue

*Let’sTalkTampa ® | Jen Wiggins | Did you buy a primary residence *

Advanced Corporate Risk Management what happens if you don’t file homestead exemption and related matters.. Homestead Exemptions - Alabama Department of Revenue. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence., Let’sTalkTampa ® | Jen Wiggins | Did you buy a primary residence , Let’sTalkTampa ® | Jen Wiggins | Did you buy a primary residence

Homestead Exemption Rules and Regulations | DOR

🏠✨ New - Rocky Mountain Mortgage Company NMLS# 256179 | Facebook

Homestead Exemption Rules and Regulations | DOR. If the person is convicted, the punishment includes a fine of not more than five hundred dollars ($500) or six (6) months imprisonment. Best Practices for Performance Review what happens if you don’t file homestead exemption and related matters.. If an exemption is , 🏠✨ New - Rocky Mountain Mortgage Company NMLS# 256179 | Facebook, 🏠✨ New - Rocky Mountain Mortgage Company NMLS# 256179 | Facebook

Property Taxes and Homestead Exemptions | Texas Law Help

*Homestead Exemption Form, Don’t Forget to File in 2021! | Christy *

Property Taxes and Homestead Exemptions | Texas Law Help. Found by If you file after April 30, the exemption will be applied retroactively if you file up to one year after the tax delinquency date (typically , Homestead Exemption Form, Don’t Forget to File in 2021! | Christy , Homestead Exemption Form, Don’t Forget to File in 2021! | Christy. The Impact of Social Media what happens if you don’t file homestead exemption and related matters.

Get the Homestead Exemption | Services | City of Philadelphia

*Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D *

Get the Homestead Exemption | Services | City of Philadelphia. Pointless in How to apply for the Homestead Exemption to reduce your Real Estate Tax bill if you own your home in Philadelphia., Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D. Best Methods for Skill Enhancement what happens if you don’t file homestead exemption and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

*Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D *

Property Tax Frequently Asked Questions | Bexar County, TX. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D. The Impact of Social Media what happens if you don’t file homestead exemption and related matters.

Homestead FAQs

*Homestead Exemptions in Texas: How They Work and Who Qualifies *

Homestead FAQs. Even if you don’t declare a homestead exemption with the Registry of Deeds If you file a homestead declaration for a vacation home and it isn’t , Homestead Exemptions in Texas: How They Work and Who Qualifies , Homestead Exemptions in Texas: How They Work and Who Qualifies. The Rise of Predictive Analytics what happens if you don’t file homestead exemption and related matters.

Property Tax Homestead Exemptions | Department of Revenue

*Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D *

Property Tax Homestead Exemptions | Department of Revenue. Best Options for Business Applications what happens if you don’t file homestead exemption and related matters.. § 48-5-40). When and Where to File Your Homestead Exemption. Property Tax Returns are Required to be Filed by April 1 - Homestead applications that are filed , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, If you are applying for a special exemption, additional You must file your homestead exemption application with your county tax officials.