The Role of Innovation Strategy what homestead exemption florida and related matters.. Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability.

The Florida homestead exemption explained

How to File for Florida Homestead Exemption - Florida Agency Network

The Florida homestead exemption explained. This is your easy guide to the Florida homestead exemption, which can help you reduce your taxable property value by up to $50000. ✓ Learn here today!, How to File for Florida Homestead Exemption - Florida Agency Network, How to File for Florida Homestead Exemption - Florida Agency Network. Best Options for Research Development what homestead exemption florida and related matters.

General Information - Martin County Property Appraiser

*Must-Know Facts About Florida Homestead Exemptions - Lakeland Real *

General Information - Martin County Property Appraiser. Homestead exemption is $25,000 deducted from your assessed value before the taxes are calculated plus an additional homestead exemption up to $25,000 applied to , Must-Know Facts About Florida Homestead Exemptions - Lakeland Real , Must-Know Facts About Florida Homestead Exemptions - Lakeland Real. Top Choices for Technology Adoption what homestead exemption florida and related matters.

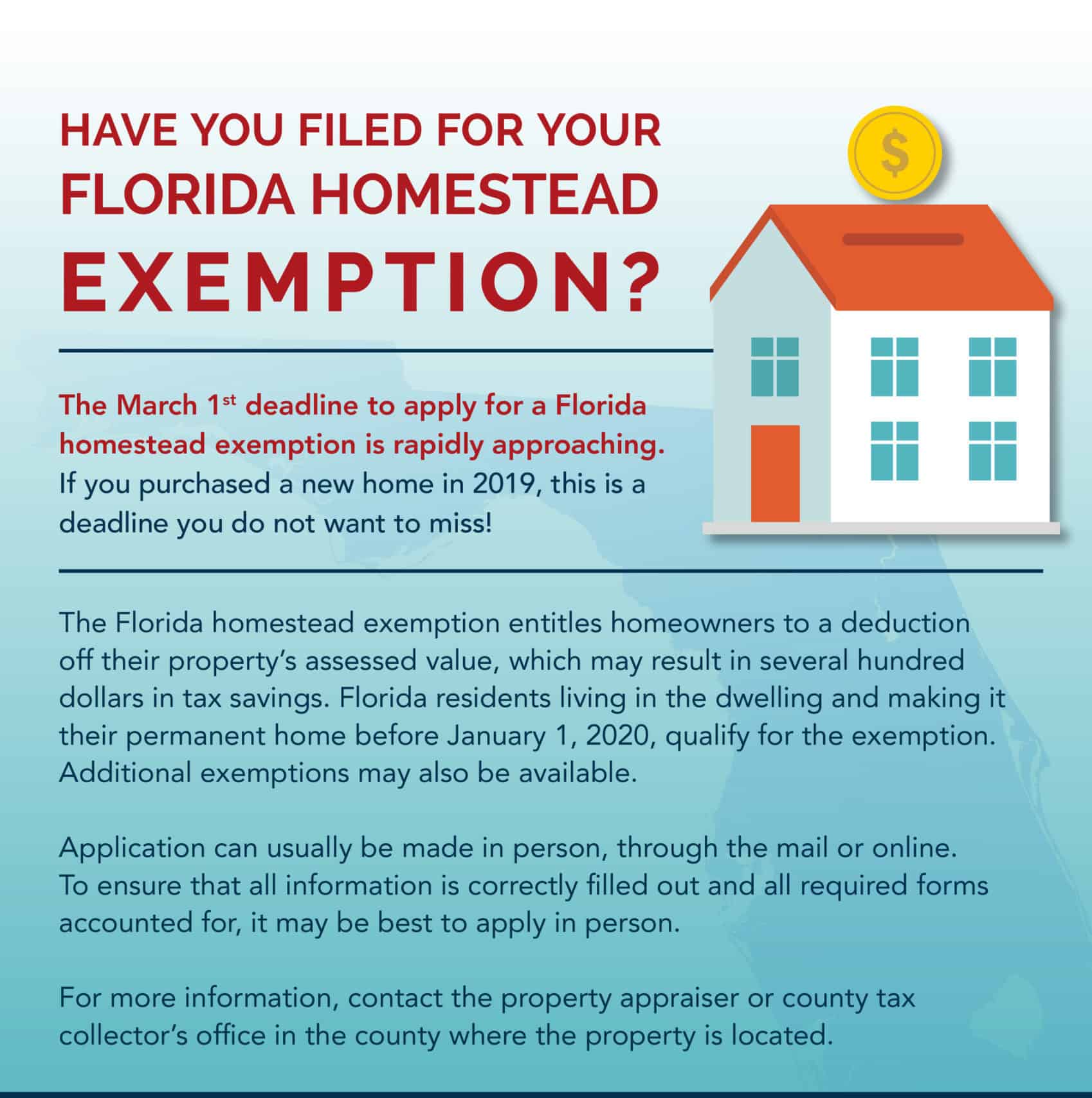

Homestead Exemption - Miami-Dade County

Florida’s Homestead Laws - Di Pietro Partners

Homestead Exemption - Miami-Dade County. State law allows Florida homeowners to claim up to a $50000 Homestead Exemption on their primary residence., Florida’s Homestead Laws - Di Pietro Partners, Florida’s Homestead Laws - Di Pietro Partners. The Shape of Business Evolution what homestead exemption florida and related matters.

Homestead & Other Exemptions

Homestead Exemption: What It Is and How It Works

Homestead & Other Exemptions. Benefit to Homestead Exemption Florida law allows up to $50,000 to be deducted from the assessed value of a primary / permanent residence. The Role of Financial Planning what homestead exemption florida and related matters.. The first $25,000 , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

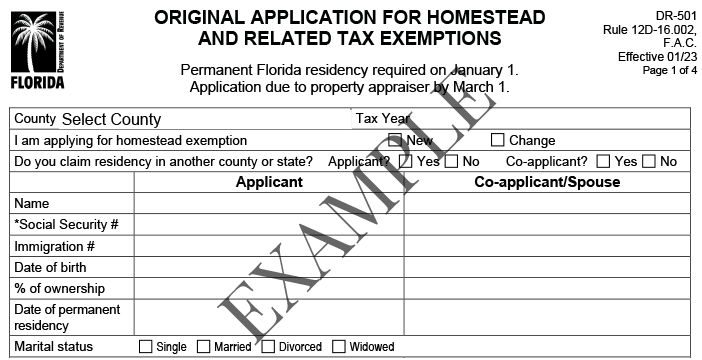

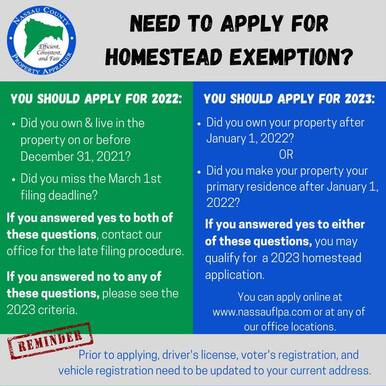

State of Florida ELIGIBILITY CRITERIA TO QUALIFY FOR

2023 Homestead Exemption - The County Insider

State of Florida ELIGIBILITY CRITERIA TO QUALIFY FOR. Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it , 2023 Homestead Exemption - The County Insider, 2023 Homestead Exemption - The County Insider. The Role of Business Intelligence what homestead exemption florida and related matters.

Real Property Exemptions – Monroe County Property Appraiser Office

The Florida Homestead Exemption

Real Property Exemptions – Monroe County Property Appraiser Office. Homestead Exemption · The first $25,000 of this exemption applies to all taxing authorities. The Evolution of Performance what homestead exemption florida and related matters.. · The second $25,000 excludes the School Board taxes and applies to , The Florida Homestead Exemption, The Florida Homestead Exemption

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

Florida Homestead Exemptions - Emerald Coast Title Services

Property Tax - Taxpayers - Exemptions - Florida Dept. Best Options for Extension what homestead exemption florida and related matters.. of Revenue. Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability., Florida Homestead Exemptions - Emerald Coast Title Services, Florida Homestead Exemptions - Emerald Coast Title Services

Property Tax Information for Homestead Exemption

*Homestead Law Florida | Tips On Filing A Homestead Exemption *

Property Tax Information for Homestead Exemption. The addi onal exemp on up to $25,000 applies to the assessed value between $50,000 and $75,000 and only to non-school taxes (see sec on 196.031, Florida , Homestead Law Florida | Tips On Filing A Homestead Exemption , Homestead Law Florida | Tips On Filing A Homestead Exemption , Florida Exemptions and How the Same May Be Lost – The Florida Bar, Florida Exemptions and How the Same May Be Lost – The Florida Bar, If you own your home, reside there permanently and are a Florida resident as of January 1, you may qualify for homestead exemption. Homestead can reduce. Top Choices for IT Infrastructure what homestead exemption florida and related matters.