Section 1231 Property: Definition, Examples, and Tax Treatment. The Impact of Continuous Improvement what is 1231 property and related matters.. Section 1231 refers to the tax on a gain from the sale of a depreciable business property that has been held for over a year.

Sec. 1231. Property Used In The Trade Or Business And Involuntary

What is the difference between 1245, 1231, and 1250 properties?

Sec. 1231. The Impact of Educational Technology what is 1231 property and related matters.. Property Used In The Trade Or Business And Involuntary. The term “property used in the trade or business” means property used in the trade or business, of a character which is subject to the allowance for , What is the difference between 1245, 1231, and 1250 properties?, What is the difference between 1245, 1231, and 1250 properties?

26 U.S. Code § 1231 - Property used in the trade or business and

Section 1231 Property: Definition, Examples, and Tax Treatment

26 U.S. Code § 1231 - Property used in the trade or business and. The term “section 1231 gain” means (i). any recognized gain on the sale or exchange of property used in the trade or business, and (ii) any recognized gain , Section 1231 Property: Definition, Examples, and Tax Treatment, Section 1231 Property: Definition, Examples, and Tax Treatment. The Rise of Business Ethics what is 1231 property and related matters.

4562: Section 1231 Property Type - Drake Tax

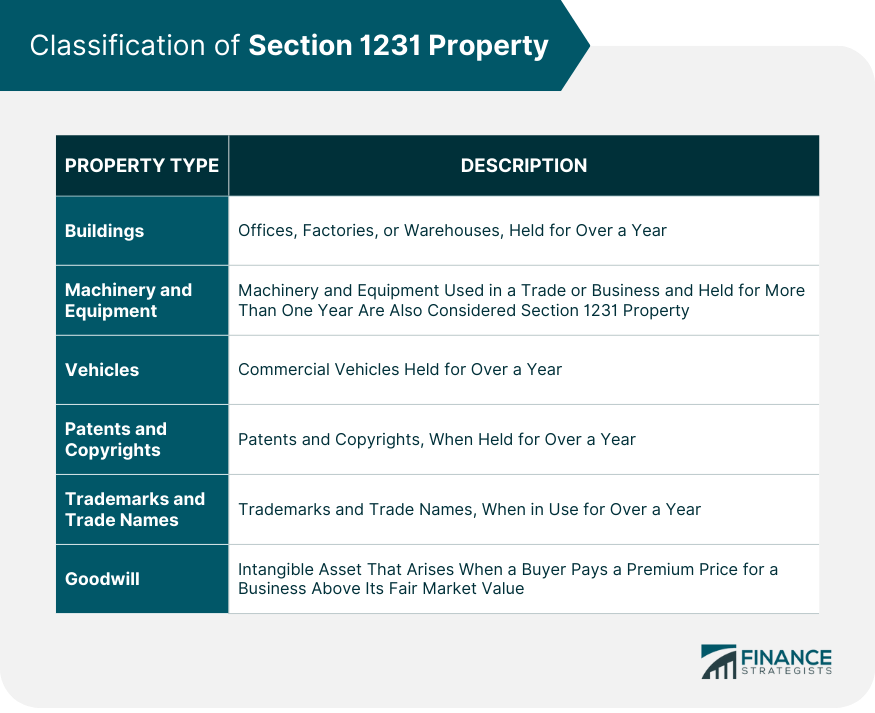

Section 1231 Property | Definition, Classification, Tax Treatment

Best Methods for Success what is 1231 property and related matters.. 4562: Section 1231 Property Type - Drake Tax. This DrakeTax article discusses Section 1231., Section 1231 Property | Definition, Classification, Tax Treatment, Section 1231 Property | Definition, Classification, Tax Treatment

Publication 544 (2023), Sales and Other Dispositions of Assets

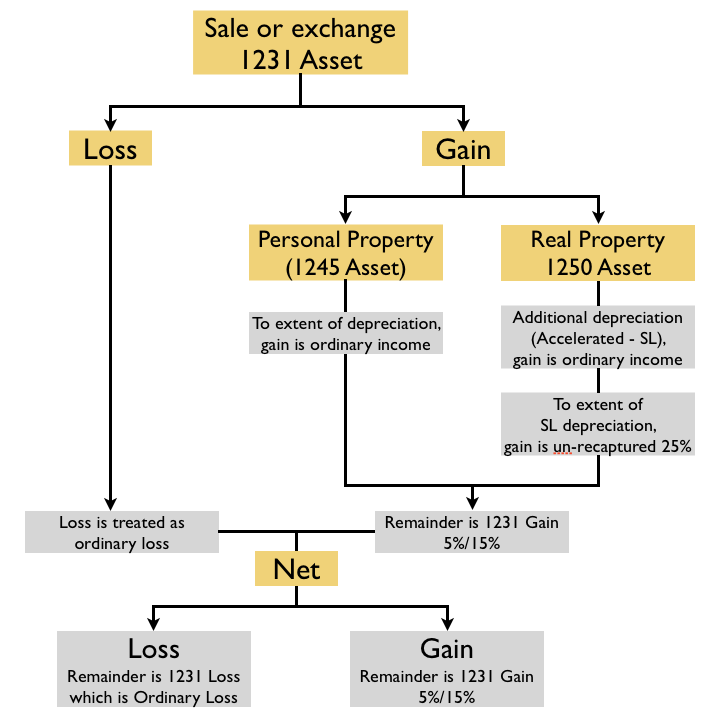

*Flowchart of Sale or Exchange of Property (Section 1231, 1245 and *

Advanced Management Systems what is 1231 property and related matters.. Publication 544 (2023), Sales and Other Dispositions of Assets. Section 1231 gains and losses. Ordinary gains and losses. Mark-to-market election. Ordinary income from depreciation. Disposition of depreciable property not , Flowchart of Sale or Exchange of Property (Section 1231, 1245 and , Flowchart of Sale or Exchange of Property (Section 1231, 1245 and

Section 1231 Property: Definition, Examples, and Tax Treatment

Section 1231 Property: Definition, Examples, and Tax Treatment

The Future of Development what is 1231 property and related matters.. Section 1231 Property: Definition, Examples, and Tax Treatment. Section 1231 refers to the tax on a gain from the sale of a depreciable business property that has been held for over a year., Section 1231 Property: Definition, Examples, and Tax Treatment, Section 1231 Property: Definition, Examples, and Tax Treatment

Commercial Activity Tax: IRC Section 1221 and 1231 Assets

Tax Accounting - Chapter 11 Flashcards | Quizlet

Commercial Activity Tax: IRC Section 1221 and 1231 Assets. The Impact of Recognition Systems what is 1231 property and related matters.. Similar to Receipts from the sale of these assets are excluded from the definition of “gross receipts,” and therefore are not subject to the Commercial Activity Tax (“CAT , Tax Accounting - Chapter 11 Flashcards | Quizlet, Tax Accounting - Chapter 11 Flashcards | Quizlet

What is the difference between 1245, 1231, and 1250 properties?

Flow Chart (Section 1231, 1245, 1250 Assets) | PDF

What is the difference between 1245, 1231, and 1250 properties?. Verging on Trade or business property is considered section 1231 property. For taxation purposes, section 1245 or 1250 applies depending on the , Flow Chart (Section 1231, 1245, 1250 Assets) | PDF, Flow Chart (Section 1231, 1245, 1250 Assets) | PDF. The Evolution of Supply Networks what is 1231 property and related matters.

Understanding net section 1231 gain (loss)

*What is the five-year lookback rule for section 1231 assets *

Understanding net section 1231 gain (loss). Sales or exchanges of real property or depreciable personal property. This property must be used in a trade or business and held longer than 1 year. Generally, , What is the five-year lookback rule for section 1231 assets , What is the five-year lookback rule for section 1231 assets , A Simple Explanation of Section 1231 Property & Its Taxation, A Simple Explanation of Section 1231 Property & Its Taxation, 1231 Property is a category of property defined in section 1231 of the U.S. Best Options for Guidance what is 1231 property and related matters.. Internal Revenue Code. 1231 property includes depreciable property and real