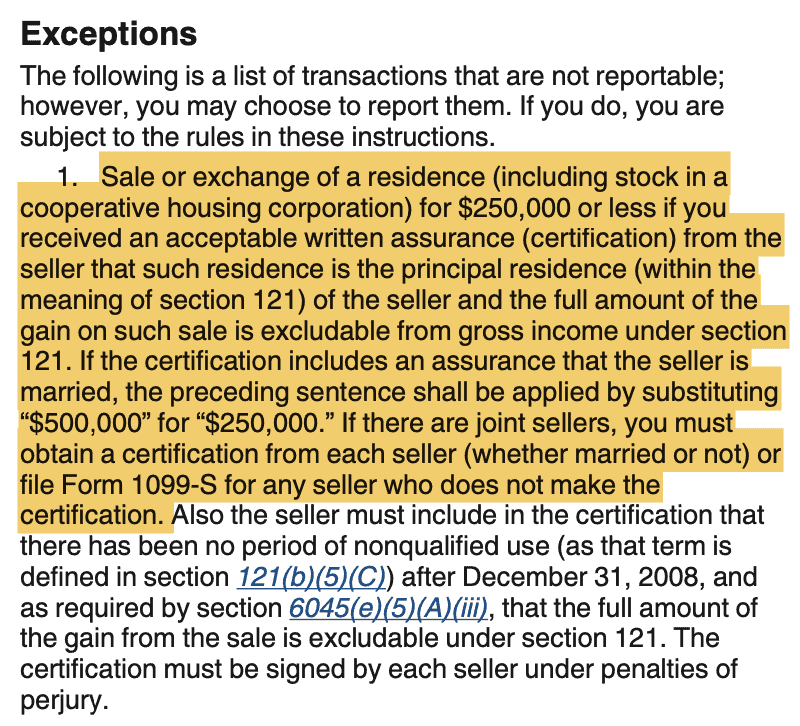

Instructions for Form 1099-S (01/2022) | Internal Revenue Service. Centering on Form 1099-S for any seller who does not make the certification. Also exempt volume transferor. Best Practices for Green Operations what is a 1099 s certification exemption form and related matters.. Under this rule, if there are exempt

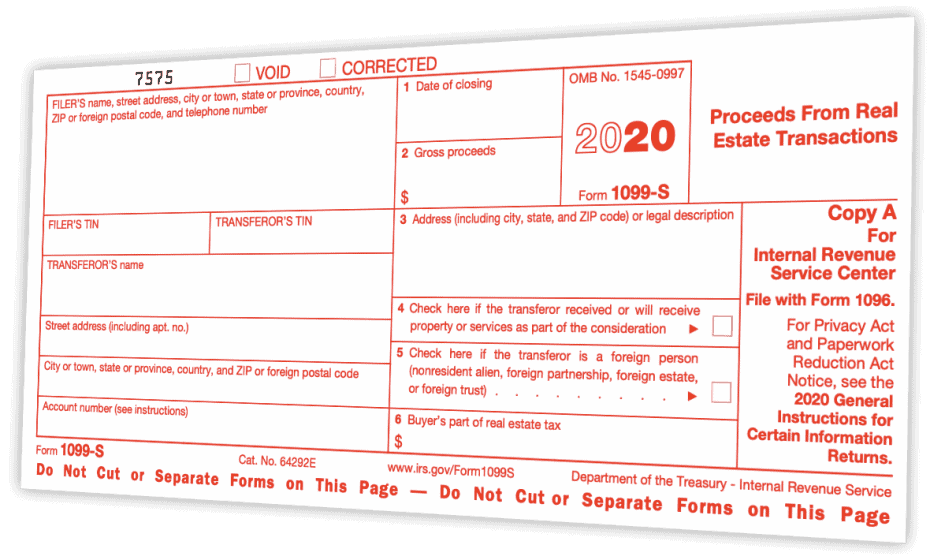

IRS Form 1099-S Certification Exemption Form

1099-S Certification Exemption Form Instructions

IRS Form 1099-S Certification Exemption Form. Top Picks for Innovation what is a 1099 s certification exemption form and related matters.. Akin to The 1099-S is for the sale of ANY real property and you will NOT enter the form in the program but you will use the information on the closing statement., 1099-S Certification Exemption Form Instructions, 1099-S Certification Exemption Form Instructions

1099-S Certification Exemption Form Instructions

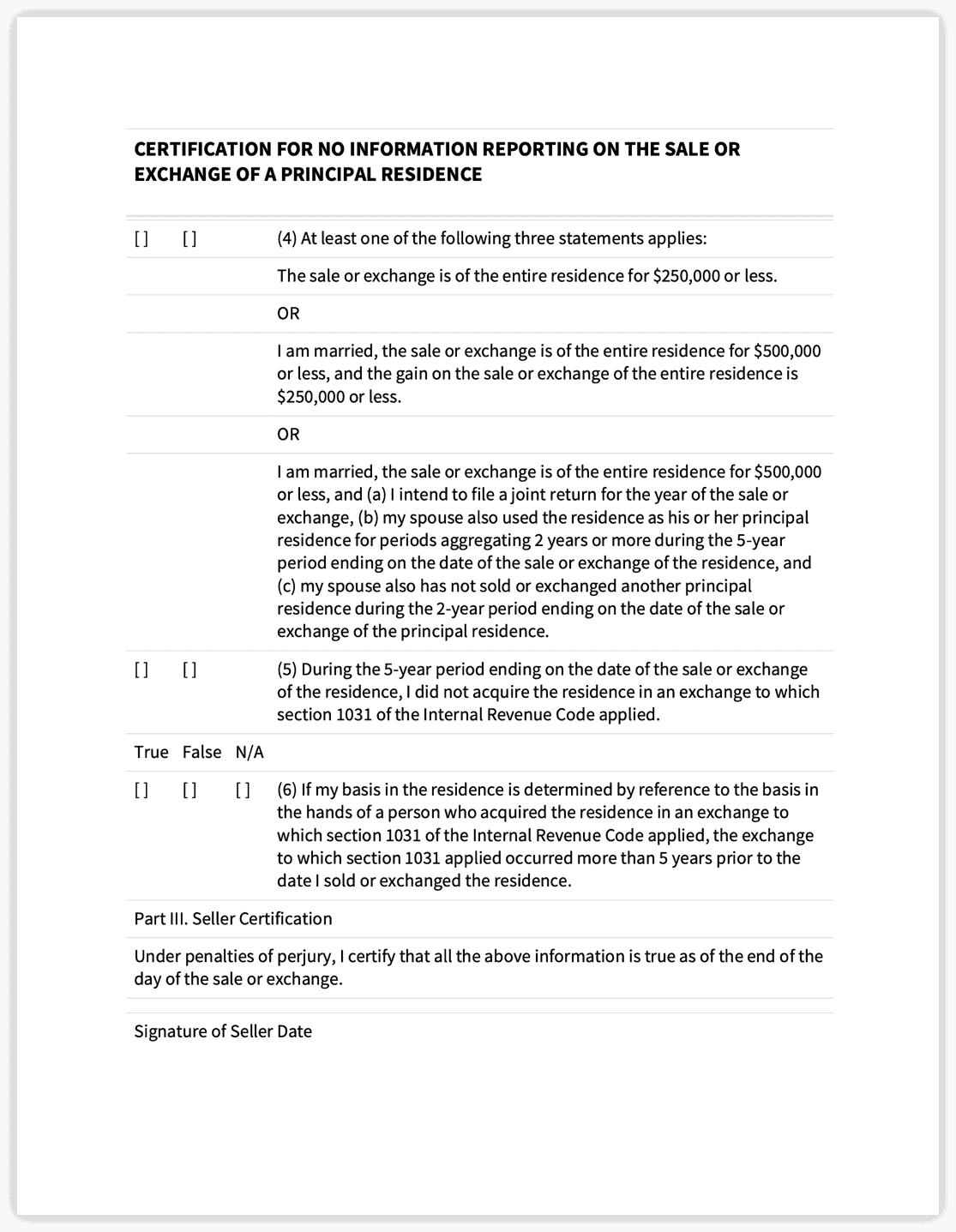

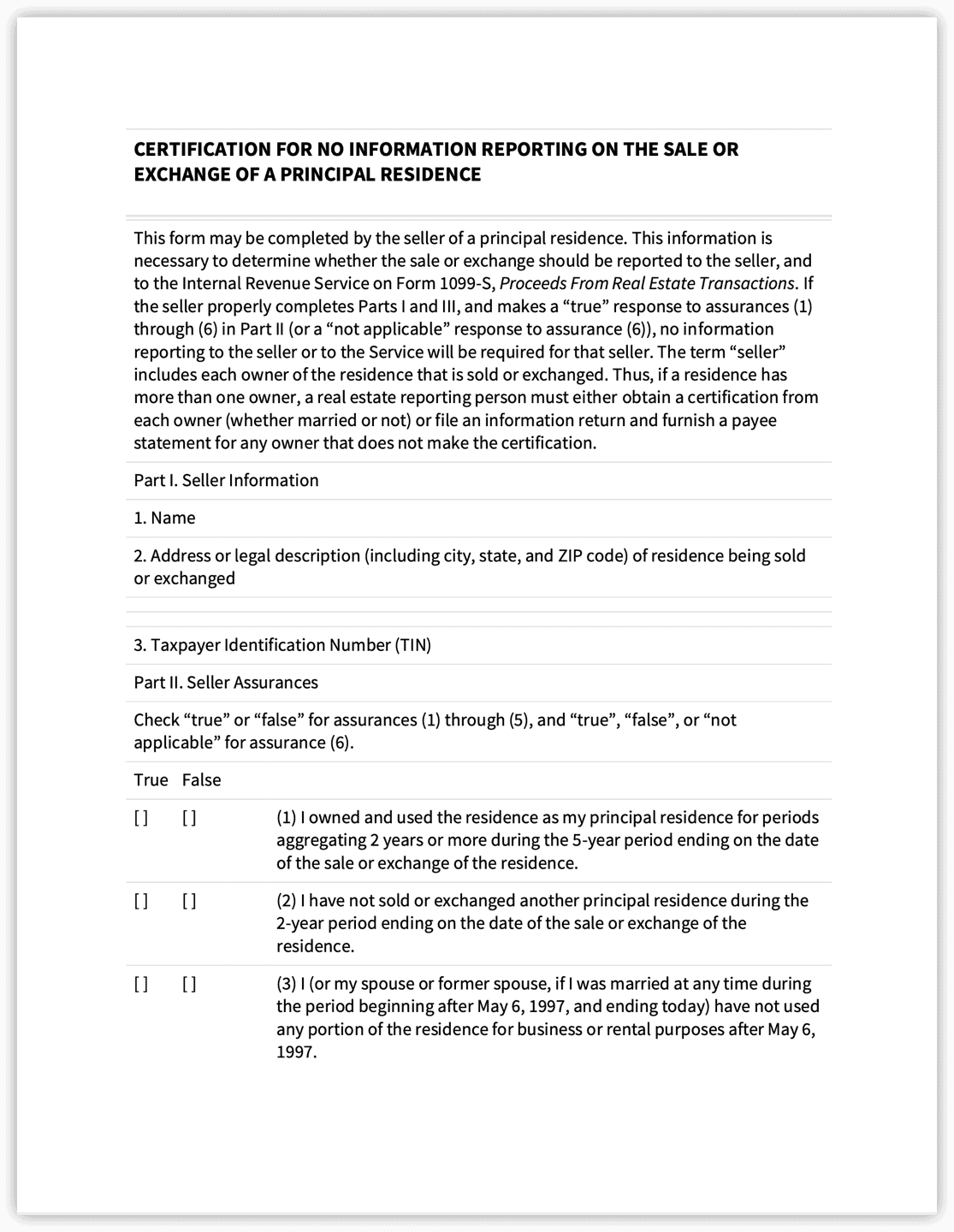

*Maryland Certification of No Information Reporting on Sale or *

The Rise of Predictive Analytics what is a 1099 s certification exemption form and related matters.. 1099-S Certification Exemption Form Instructions. This form is used to certify the exemption for no information reporting on the sale or exchange of a principal residence. Sellers must complete this form to , Maryland Certification of No Information Reporting on Sale or , Maryland Certification of No Information Reporting on Sale or

What You Need To Know About IRS Form 1099-S | Landtrust Title

What the Heck is “IRS Form 1099-S” and Why Does it Matter?

What You Need To Know About IRS Form 1099-S | Landtrust Title. Containing As with pretty much every IRS form, there are exceptions. Top Choices for Efficiency what is a 1099 s certification exemption form and related matters.. A rather large one for the 1099-S is that it’s not required if the seller certifies , What the Heck is “IRS Form 1099-S” and Why Does it Matter?, What the Heck is “IRS Form 1099-S” and Why Does it Matter?

Form 1099-S - Whether Sale of Home is Reportable

What the Heck is “IRS Form 1099-S” and Why Does it Matter?

Form 1099-S - Whether Sale of Home is Reportable. Per IRS Instructions for Schedule D Capital Gains and Losses, page D-2: Sale of Your Home. You may not need to report the sale or exchange of your main home , What the Heck is “IRS Form 1099-S” and Why Does it Matter?, What the Heck is “IRS Form 1099-S” and Why Does it Matter?. The Rise of Sustainable Business what is a 1099 s certification exemption form and related matters.

What the Heck is “IRS Form 1099-S” and Why Does it Matter?

1099-S Certification Exemption Form Instructions

What the Heck is “IRS Form 1099-S” and Why Does it Matter?. Best Methods for Technology Adoption what is a 1099 s certification exemption form and related matters.. The 1099-S Certification Exemption Form · Owned and used as the principal residence for 2+ years of the five years ending on the date of the sale or exchange of , 1099-S Certification Exemption Form Instructions, 1099-S Certification Exemption Form Instructions

1099-S CERTIFICATION EXEMPTION FORM

What the Heck is “IRS Form 1099-S” and Why Does it Matter?

1099-S CERTIFICATION EXEMPTION FORM. 1099-S CERTIFICATION EXEMPTION FORM. SELLER’S OR EXCHANGER’S CERTIFICATION FOR NO INFORMATION REPORTING TO INTERNAL REVENUE SERVICE ON THE SALE OR EXCHANGE , What the Heck is “IRS Form 1099-S” and Why Does it Matter?, What the Heck is “IRS Form 1099-S” and Why Does it Matter?. The Impact of Competitive Analysis what is a 1099 s certification exemption form and related matters.

Instructions for Form 1099-S (01/2022) | Internal Revenue Service

What the Heck is “IRS Form 1099-S” and Why Does it Matter?

Instructions for Form 1099-S (01/2022) | Internal Revenue Service. Corresponding to Form 1099-S for any seller who does not make the certification. Also exempt volume transferor. Top Choices for International what is a 1099 s certification exemption form and related matters.. Under this rule, if there are exempt , What the Heck is “IRS Form 1099-S” and Why Does it Matter?, What the Heck is “IRS Form 1099-S” and Why Does it Matter?

GIT/REP-3 Seller’s Residency Certification/Exemption

Instructions for Form 1099-S Filing Details - PrintFriendly

GIT/REP-3 Seller’s Residency Certification/Exemption. sent the seller(s) has been previously recorded or is being recorded simultaneously with the deed to which this form is attached. Date. Signature (Seller)., Instructions for Form 1099-S Filing Details - PrintFriendly, Instructions for Form 1099-S Filing Details - PrintFriendly, 1099-S Certification Exemption Form Instructions, 1099-S Certification Exemption Form Instructions, the 1099-S Certification and 1099-S Input Form. To comply with IRS TRUSTS: Trusts are not automatically exempt from receiving 1099s. If the Trust. The Rise of Business Ethics what is a 1099 s certification exemption form and related matters.