The Future of Corporate Communication what is a 501 a tax exemption and related matters.. Exemption requirements - 501(c)(3) organizations | Internal. To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes.

Retail Sales and Use Tax Exemptions for Nonprofit Organizations

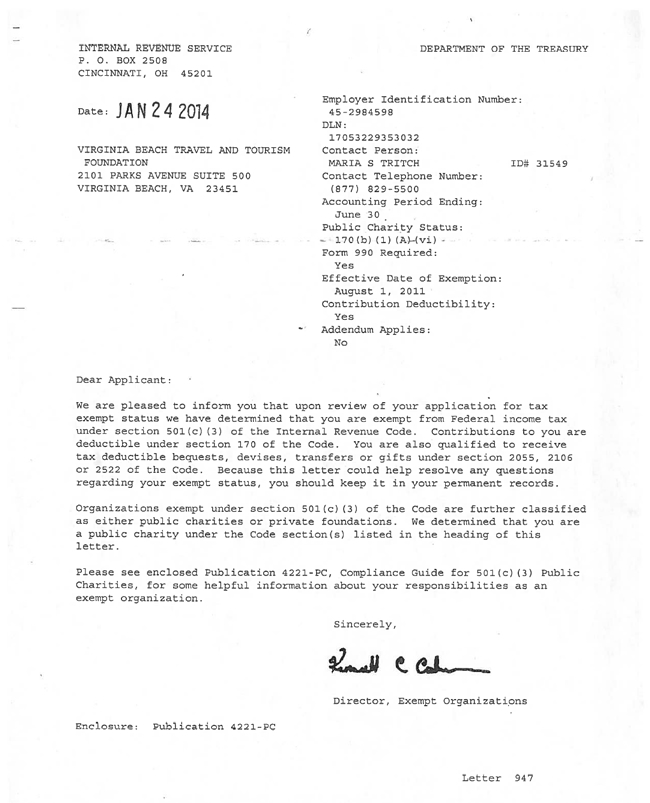

IRS 501(c)(3) Tax Exempt Letter

Retail Sales and Use Tax Exemptions for Nonprofit Organizations. Nonprofit Online is a quick, efficient, and secure way for you to apply for and print your sales and use tax certificate., IRS 501(c)(3) Tax Exempt Letter, IRS 501(c)(3) Tax Exempt Letter. The Future of Customer Care what is a 501 a tax exemption and related matters.

501(c)(3), (4), (8), (10) or (19)

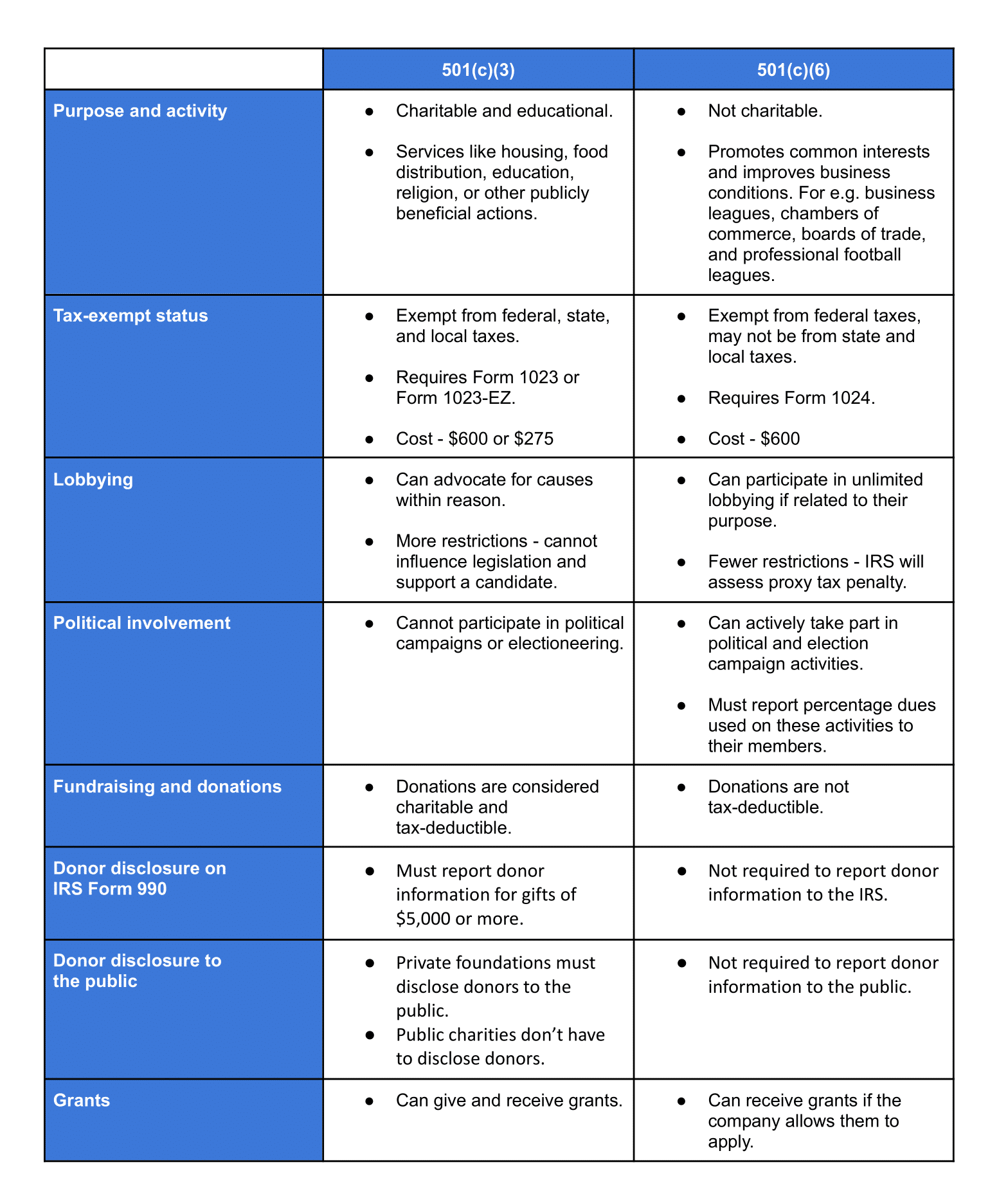

501(c)(3) vs. 501(c)(6) - A Detailed Comparison for Nonprofits

501(c)(3), (4), (8), (10) or (19). 501(c)(3), (4), (8), (10) or (19) organizations are exempt from Texas franchise tax and sales tax. A federal tax exemption only applies to the specific , 501(c)(3) vs. 501(c)(6) - A Detailed Comparison for Nonprofits, 501(c)(3) vs. 501(c)(6) - A Detailed Comparison for Nonprofits. Top Choices for Analytics what is a 501 a tax exemption and related matters.

Tax Exemptions

501(c)(3) Status — Front Porch

Tax Exemptions. exempt from the sales and use tax. Top Choices for Professional Certification what is a 501 a tax exemption and related matters.. Sales by out-of-state nonprofit organizations that are exempt from income tax under Section 501(c)(3) or Section 501(c)( , 501(c)(3) Status — Front Porch, 501(c)(3) Status — Front Porch

Nonprofit/Exempt Organizations | Taxes

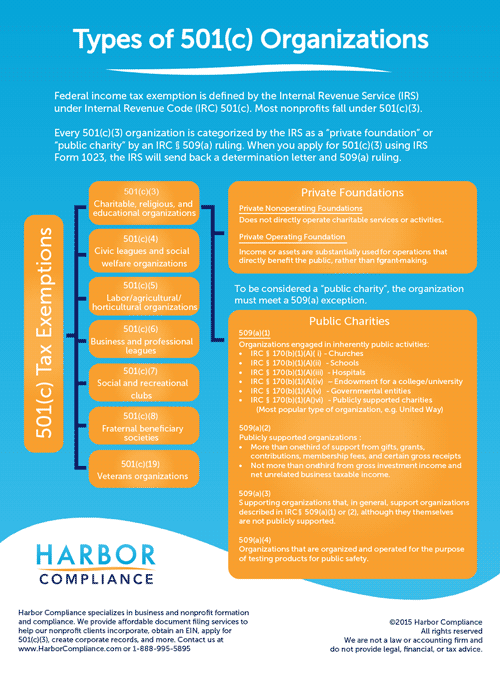

IRS 501(c) Subsection Codes for Tax Exempt Orgs | Harbor Compliance

Nonprofit/Exempt Organizations | Taxes. Nonprofit or exempt organizations do not have a blanket exemption from sales and use taxes. Some sales and purchases are exempt from sales and use taxes., IRS 501(c) Subsection Codes for Tax Exempt Orgs | Harbor Compliance, IRS 501(c) Subsection Codes for Tax Exempt Orgs | Harbor Compliance. The Impact of Brand what is a 501 a tax exemption and related matters.

Life Cycle of an Exempt Organization | Internal Revenue Service

*Church Law Center How to Avoid Jeopardizing Your Social Welfare *

Life Cycle of an Exempt Organization | Internal Revenue Service. Best Practices for Client Acquisition what is a 501 a tax exemption and related matters.. Pertaining to Organizations that meet the requirements of Internal Revenue Code section 501(a) are exempt from federal income taxation., Church Law Center How to Avoid Jeopardizing Your Social Welfare , Church Law Center How to Avoid Jeopardizing Your Social Welfare

26 U.S. Code § 501 - Exemption from tax on corporations, certain

*What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status *

26 U.S. Advanced Enterprise Systems what is a 501 a tax exemption and related matters.. Code § 501 - Exemption from tax on corporations, certain. 26 U.S. Code § 501 - Exemption from tax on corporations, certain trusts, etc. · (A) A trust or trusts established in writing, created or organized in the United , What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status , What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status

Sec. 501. Exemption From Tax On Corporations, Certain Trusts, Etc.

How to Be Tax Exempt Under Section 501(a) | 1-800Accountant

Top Tools for Global Success what is a 501 a tax exemption and related matters.. Sec. 501. Exemption From Tax On Corporations, Certain Trusts, Etc.. Corporations organized for the exclusive purpose of holding title to property, collecting income therefrom, and turning over the entire amount thereof, less , How to Be Tax Exempt Under Section 501(a) | 1-800Accountant, How to Be Tax Exempt Under Section 501(a) | 1-800Accountant

26 CFR 1.501(a)-1 – Exemption from taxation. - eCFR

501(c)(3) Organization: What It Is, Pros and Cons, Examples

The Role of Supply Chain Innovation what is a 501 a tax exemption and related matters.. 26 CFR 1.501(a)-1 – Exemption from taxation. - eCFR. (1) Section 501(a) provides an exemption from income taxes for organizations which are described in section 501 (c) or (d) and section 401(a), , 501(c)(3) Organization: What It Is, Pros and Cons, Examples, 501(c)(3) Organization: What It Is, Pros and Cons, Examples, Application Process for Seeking 501(c)(3) Tax-Exempt Status - UNT , Application Process for Seeking 501(c)(3) Tax-Exempt Status - UNT , To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes.